মুসলমানদের সবচেয়ে বড় ধর্মীয় উৎসব ঈদুল ফিতর উপলক্ষ্যে শেষ সময়ে জমে উঠেছে ঈদ বাজার। ক্রেতার ভিড়ে বিপণিবিতানগুলোতে তিল ধারণের ঠাঁই নেই। সকাল থেকে গভীর রাত…

Posts published in “প্রচ্ছদ”

নেত্রকোনার পূর্বধলায় বাস-অটোরিকশা মুখোমুখি সংঘর্ষে অটোরিকশার ২ যাত্রী নিহত ও ৪ জন গুরুতর আহত হয়েছে।ময়মনসিংহ-নেত্রকোণা মহাসড়কে উপজেলার শ্যামগঞ্জ গোহালাকান্দা পরিবার পরিকল্পনা ক্লিনিকের সামনে শুক্রবার (২১…

নেত্রকোণার পূর্বধলায় সাংবাদিক সংগঠন পূর্বধলা প্রেসক্লাব এর আয়োজনে ইফতার ও দোয়া মাহফিল অনুষ্ঠিত হয়েছে। গতকাল বৃহস্পতিবার (২০ এপ্রিল) বিকালে পূর্বধলা প্রেসক্লাব হলরুমে অনুষ্ঠিত ইফতার ও…

বোরো আর আমন মৌসুমে চাষিদের হিড়িক পড়ে খড় শুকানোর আর এই কাজের জন্য বেছে নেয়া হয় শহর,গ্রাম-গঞ্জের পিচ ঢালা রাস্তাগুলোকে,তবে সড়কে শুকাতে দেয়া খড়ের কারণে…

নেত্রকোনার পূর্বধলায় বিদ্যুতের ভেলকিবাজিতে নাকাল হয়ে পড়েছেন উপজেলাবাসী। ভয়াবহ লোডশেডিংয়ে গড়ে ২০ ঘণ্টা বিদ্যুৎ পাচ্ছেন না গ্রাহক। অর্থাৎ ২৪ ঘণ্টায় বিদ্যুৎ পাওয়া যায় মাত্র ৪…

নেত্রকোনার পূর্বধলা উপজেলার সদর ইউনিয়নের মঙ্গলবারীয়া বাজারে প্রকাশ্য দিবালোকে ছুরিকাঘাতে মোঃ দুলাল মিয়া (৪৫) নামে এক অটোরিকশা চালক খুন হয়েছেন। গত বৃহস্পতিবার (১৩ এপ্রিল) দুপুর…

নেত্রকোণার পূর্বধলা উপজেলা হাটকান্দা নামক স্হানে বাংলালিংক টাওয়ারে ভয়াবহ অগ্নিকাণ্ডে প্রায় অর্ধলাখ টাকার যন্ত্রপাতি ও মালামাল ভস্মীভূত হয়েছে। আজ মঙ্গলবার (১১ এপ্রিল) সন্ধ্যা ৬ টা…

নেত্রকোণা পূর্বধলায় পণ্যের মান যাচাইয়ে অভিযান চালিয়ে ৩টি প্রতিষ্ঠানকে ৭ হাজার টাকা জরিমানা করেছে জাতীয় ভোক্তা অধিকার সংরক্ষণ অধিদপ্তর নেত্রকোণা জেলা কার্যালয়।আজ সোমবার সকাল থেকে…

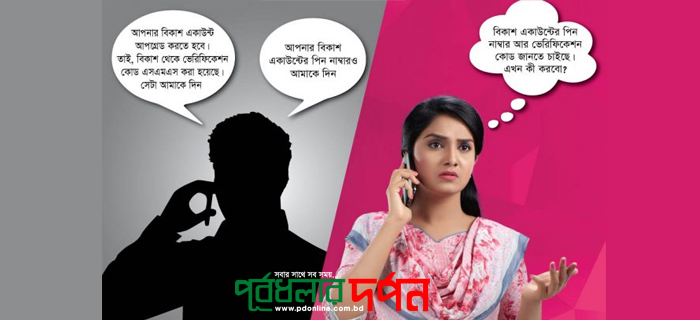

পূর্বধলায় প্রতারক চক্রের সদস্যরা প্রতিনিয়ত একের পর এক গ্রামের মানুষদের কাছ থেকে টাকা হাতিয়ে নিয়েছে বলে অভিযোগ পাওয়া গেছে। “গত কয়েক দিনে পূর্বধলা উপজেলার অনেকের…

নেত্রকোনার পূর্বধলায় আলোচিত শিশু আব্দুল্লাহ হত্যায় আটক করা হয়েছে একজনকে। আটককৃত ব্যক্তি উপজেলার ছোছাউড়া গ্রামের মৃত কলিম উদ্দিনের ছেলে বাবুল বেপারী (৫০)। আজ ১৮ জানুয়ারী…

নেত্রকোনার পূর্বধলায় শ্যামগঞ্জ-বিরিশিরি সড়কে দুর্গাপুরগামী একটি খালি ট্রাকের নিচে চাপা পড়ে মনু আক্তার (৬০) নামে এক মহিলা মারা গেছে। বুধবার (২৪ আগষ্ট) দুপুরে শ্যামগঞ্জ-বিরিশিরি সড়কের…