নেত্রকোনার পূ্র্বধলায় এক অজ্ঞাত ব্যক্তির লাশ উদ্ধার করেছে পূর্বধলা থানা পুলিশ। শনিবার (১৫ জুলাই ) দুপুরে উপজেলার হোগলা ইউনিয়নের পাটরা-দামপাড়া উচ্চ বিদ্যালয়ের সাথে কংস নদ…

Posts published in “প্রচ্ছদ”

নেত্রকোনার পূর্বধলা ২০২২-২৩ অর্থবছর শেষ হয়ে গেলেও এখন পর্যন্ত ঠিকাদারই নিয়োগ করতে পারেনি উপজেলা স্বাস্থ্য কমপ্লেক্স কর্তৃপক্ষ। রোগীদের পথ্য খাদ্যদ্রব্য, ধোলাই ও স্টেশনারি সরবরাহে ঠিকাদার…

নেত্রকোনার পূর্বধলায় রাগীব মুজিব উচ্চ বিদ্যালয়ের প্রধান শিক্ষক মোঃ আতাহার আলী’র বিরুদ্ধে নিয়োগে অর্থ আত্মসাৎসহ নানা অভিযোগ উঠেছে। ১৯৯৫ ইং সনে উপজেলার পূর্বধলা সদর ইউনিয়নের…

সারাদেশের ন্যায় নেত্রকোনার পূর্বধলায় প্রধানমন্ত্রী শেখ হাসিনার ৪৩তম স্বদেশ প্রত্যাবর্তন দিবস পালিত হয়েছে। দিবসটি উপলক্ষে আ.লীগের সাংগঠনিক সম্পাদক আহমদ হোসেন’র নির্দেশনায় বুধবার (১৭ মে) উপজেলা…

নেত্রকোণার পূর্বধলা উপজেলা ঘাগড়া ইউনিয়নের লেটিরকান্দা বিরল রোগে আক্রান্ত তায়্যিবা(৮)। এ সংক্রান্ত একটি সংবাদ স্থানীয় ও জাতীয়ভাবে প্রচারের পর সেই তায়্যিবার চিকিৎসার দায়িত্ব নিল পূর্বধলা…

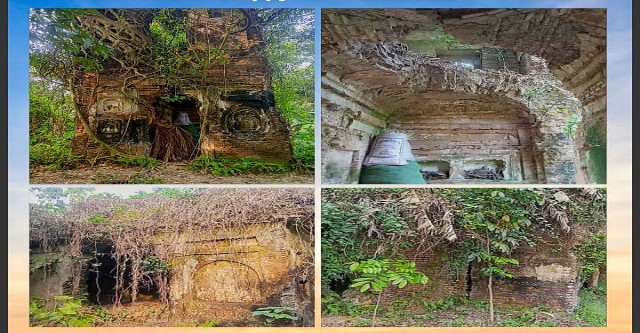

নেত্রকোণা জেলার পূর্বধলা উপজেলার নারায়ণডহর গ্রামে অবস্থিত এক ঐতিহাসিক জমিদার বাড়ি। বর্তমানে নারায়ণডহর পূর্বধলা উপজেলার একটি অন্যতম জমজমাট বাজার হিসেবে ব্যবহৃত হলেও প্রাচীন জমিদার বাড়ীর…

নেত্রকোনার পূর্বধলায় ওড়না গলায় ফাঁস দিয়ে শাহানা আক্তার (২২) নামে এক নারী আত্মহত্যা করেন। শুক্রবার (২৮ এপ্রিল) সন্ধ্যা ৭ টায় উপজেলার বিশকাকুনী ইউনিয়নের বিশকাকুনী পশ্চিমপাড়া…

নেত্রকোণা পূর্বধলায় কেন্দ্রীয় ছাত্রলীগের আহ্বানে সাড়া দিয়ে পূর্বধলায় কৃষকের ধান কেটে দিল পূর্বধলা সরকারি কলেজ ছাত্রলীগের নেতাকর্মীরা। এর আগে, গত ২৪ এপ্রিল বোরো মৌসুমে কৃষকের…

নেত্রকোনার পূর্বধলায় অতিরিক্ত সিএনজি (অটোরিকশা) ভাড়া আদায়ের প্রতিবাদ করায় যাত্রীকে মারধর করার অভিযোগ পাওয়া গেছে ময়মনসিংহ থ ১১-৩৭২২ সিএনজি (অটোরিকশা) চালকের বিরুদ্ধে। আজ বুধবার (২৬…

নেত্রকোণা জেলার পূর্বধলা উপজেলার হোগলা ইউনিয়নে অগ্নিশিখা শিশু ফোরাম-এর আয়োজনে ইউনিয়ন পরিষদের হলরুমে (২৫ ই এপ্রিল) মঙ্গলবার সকাল ১১ ঘটিকায় ইউনিয়ন পরিষদের ১৫ জন জন-…

নেত্রকোণার পূর্বধলা উপজেলায় এসএসসি ২০১০ ব্যাচের শিক্ষার্থীদের পুনর্মিলনী অনুষ্ঠিত হয়েছে। “স্মৃতির টানে প্রিয় প্রাঙ্গণে এসো মিলি প্রিয় প্রাঙ্গণে” এ প্রতিপাদ্যকে ধারণ করে রবিবার ২৩ এফ্রিলপূর্বধলা…