দেশব্যাপী বিএনপি জামায়াতের ডাকা অবরোধের প্রতিবাদে নেত্রকোনার পূ্র্বধলায় স্থানীয় সাংসদ আলহাজ্ব ওয়ারেসাত হোসেন বেলাল বীর প্রতীক এমপি’র নির্দেশনায় উপজেলা যুবলীগের সাবেক আহবায়ক মাসুদ আলম তালুকদার…

Posts published in “প্রচ্ছদ”

আগামী দ্বাদশ জাতীয় সংসদ নির্বাচনকে সামনে রেখে তৃণমূলপর্যায়ে দলকে সুসংগঠিত করার লক্ষ্যে পূ্র্বধলা উপজেলার স্টেশন বাজারস্থ দলীয় কার্যালয়ে বর্ধিত সভা হয়েছে। বৃহস্পতিবার (২৫ অক্টোবর )…

নেত্রকোণা-৫ (পূ্র্বধলা) আসনের আওয়ামী লীগের মনোনয়ন প্রত্যাশী ও ঢাকা মহানগর উত্তর কৃষক লীগের সহ-সভাপতি এবং রোজা ফাউন্ডেশনের চেয়ারম্যান মাজহারুল ইসলাম সোহেলের উদ্দ্যোগে পূর্বধলা সদর ইউনিয়ন…

আগামী দ্বাদশ জাতীয় সংসদ নির্বাচনকে সামনে রেখে (৯ অক্টোবর) সোমবার সন্ধ্যায় পূ্র্বধলা রিপোর্টার্স ক্লাবের অস্থায়ী কার্যালয়ে সাংবাদিকদের সাথে মতবিনিময় করেছেন নেত্রকোনা-৫ (পূ্র্বধলা) আসনে আওয়ামী লীগের…

নেত্রকোনা জেলার পূর্বধলা উপজেলার শ্যামগঞ্জ-বিরিশিরি সড়কের গুজাখালীকান্দা এলাকায় এ দূর্ঘটনা ঘটে। একটি যাত্রীবাহী বাসকে সাইড দিতে গিয়ে নিয়ন্ত্রণ হারিয়ে সড়কের পাশে খাদে পড়ে যায় ট্রাকটি।…

নেত্রকোনার পূর্বধলায় আইন শৃঙ্খলা ও মাসিক সমন্বয় কমিটির সভা অনুষ্ঠিত হয়েছে। বুধবার (৩০ আগস্ট) উপজেলা পরিষদের সম্মেলন কক্ষে আইন শৃঙ্খলা কমিটি উদ্যোগে আইন শৃঙ্খলা সভা…

নেত্রকোণার পূর্বধলায় জাতীয় শোক দিবস উপলক্ষে আলোচনা সভা ও পূর্বধলা রিপোর্টার্স ক্লাবের ধারাবাহিক ‘কংস’ স্মরণিকার ৩য় প্রকাশনার মোড়ক উন্মোচন অনুষ্ঠান শনিবার (১৯ আগষ্ট) পূর্বধলা সরকারি…

গণপ্রজাতন্ত্রী বাংলাদেশ সরকারের তথ্য ও সম্প্রচার মন্ত্রণালয় কর্তৃক নিবন্ধিত অনলাইন নিউজ পোর্টাল আজকের আরবানের আয়োজনে গত শনিবার সন্ধায় এক মতবিনিময় সভায় অনুষ্ঠিত হয়েছে। পত্রিকাটির নিবন্ধন…

মহানবী হযরত মুহাম্মাদ রসুল ( স:) সম্পর্কে কটুক্তি ও অসালীন মন্তব্য করায় ব্লগার আসাদ নূরের দৃষ্টান্তমূলক শাস্তির দাবীতে নেত্রকোনার পূর্বধলায় মানববন্ধন অনুষ্ঠিত হয়েছে। রবিবার (১৩…

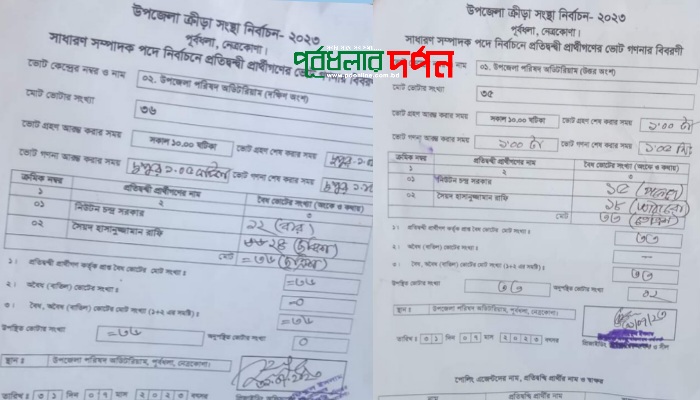

পূর্বধলা ক্রীড়া সংস্থার নির্বাচনে সাধারণ সম্পাদক পদে নির্বাচিত হয়েছেন পূর্বধলা উপজেলা স্বেচ্ছাসেবক লীগের সভাপতি, ক্রীড়ানুরাগী ব্যক্তিত্ব সৈয়দ হাসানুজ্জামান রাফি। তিনি ৪২ ভোট পেয়ে নির্বাচিত হন।…

নেত্রকোনার পূর্বধলায় একটি চাঞ্চল্যকর হত্যা মামলায় মৃত্যুদণ্ড সাজাপ্রাপ্ত পলাতক আসামিকে গ্রেপ্তার করেছে র্যাব-১৪ সিপিএসসি, ময়মনসিংহ। হত্যা মামলার মৃত্যুদন্ড প্রাপ্ত পলাতক আসামী মজিবর রহমান (৭০) পূ্র্বধলা…