চুড়ান্ত ভোটার তালিকা (২৩/০৩/২০২৪) গোহালাকান্দা ইউনিয়ন পুরো একসাথে ডাউনলোড ওয়ার্ড নং ভোটার এলাকার নাম ডাউনলোড করতে নামের উপর ক্লিক করুণ কোড ১ জালশুকা ২১২০ ১ […]

ইউনিয়ন :: হোগলা

চুড়ান্ত ভোটার তালিকা (২৩/০৩/২০২৪) হোগলা ইউনিয়ন পুরো একসাথে ডাউনলোড ওয়ার্ড নং ভোটার এলাকার নাম ডাউনলোড করতে নামের উপর ক্লিক করুণ কোড ১ শেহলারচর ২১৪৫ ১ […]

ইউনিয়ন :: নারান্দিয়া

চুড়ান্ত ভোটার তালিকা (২৩/০৩/২০২৪) নারান্দিয়া ইউনিয়ন পুরো একসাথে ডাউনলোড ওয়ার্ড নং ভোটার এলাকার নাম ডাউনলোড করতে নামের উপর ক্লিক করুণ কোড ১ দাপুনিয়া ২২৪৫ ১ […]

ইউনিয়ন :: ঘাগড়া

চুড়ান্ত ভোটার তালিকা (২৩/০৩/২০২৪) ঘাগড়া ইউনিয়ন পুরো একসাথে ডাউনলোড ওয়ার্ড নং ভোটার এলাকার নাম ডাউনলোড করতে নামের উপর ক্লিক করুণ কোড ১ বাইনজা বিয়ারকান্দা ২০৮৭ […]

ইউনিয়ন :: বৈরাটি

চুড়ান্ত ভোটার তালিকা (২৩/০৩/২০২৪) বৈরাটি ইউনিয়ন পুরো একসাথে ডাউনলোড ওয়ার্ড নং ভোটার এলাকার নাম ডাউনলোড করতে নামের উপর ক্লিক করুণ কোড ১ কাটাখালী ১৯৯০ ১ […]

ঢাকা বিশ্ববিদ্যালয় পূর্বধলা ছাত্রকল্যাণ পরিষদের ক্যারিয়ার বিষয়ক সেমিনার অনুষ্ঠিত

রাজধানীতে ঢাকা বিশ্ববিদ্যালয় পূর্বধলা ছাত্রকল্যাণ পরিষদের উদ্যোগে ডাকসু ক্যাফেটেরিয়ার শিক্ষক লাউঞ্জে আজ (১১মে) শনিবার সকালে ক্যারিয়ার বিষয়ক এক সেমিনার অনুষ্ঠিত হয়েছে। একাডেমিক পড়াশোনার পাশাপাশি পেশাজীবনে […]

ইউনিয়ন :: খলিশাউড়

চুড়ান্ত ভোটার তালিকা (২৩/০৩/২০২৪) খলিশাউড় ইউনিয়ন পুরো একসাথে ডাউনলোড ওয়ার্ড নং ভোটার এলাকার নাম ডাউনলোড করতে নামের উপর ক্লিক করুণ কোড ১ মনারকান্দা ২২০৫ ১ […]

ইউনিয়ন :: বিশকাকুনী

চুড়ান্ত ভোটার তালিকা (২৩/০৩/২০২৪) বিশকাকুনী ইউনিয়ন পুরো একসাথে ডাউনলোড ওয়ার্ড নং ভোটার এলাকার নাম ডাউনলোড করতে নামের উপর ক্লিক করুণ কোড ১ কলংকা ২০২৯ ১ […]

ইউনিয়ন :: জারিয়া

চুড়ান্ত ভোটার তালিকা (২৩/০৩/২০২৪) জারিয়া ইউনিয়ন পুরো একসাথে ডাউনলোড ওয়ার্ড নং ভোটার এলাকার নাম ডাউনলোড করতে নামের উপর ক্লিক করুণ কোড ১ নাটেরকোনা নলুয়াপাড়া ২১৮৪ […]

ইউনিয়ন :: আগিয়া

চুড়ান্ত ভোটার তালিকা (২৩/০৩/২০২৪) আগিয়া ইউনিয়ন পুরো একসাথে ডাউনলোড ওয়ার্ড নং ভোটার এলাকার নাম ডাউনলোড করতে নামের উপর ক্লিক করুণ কোড ১ ধোপাহোগলা ১৯৬৪ ১ […]

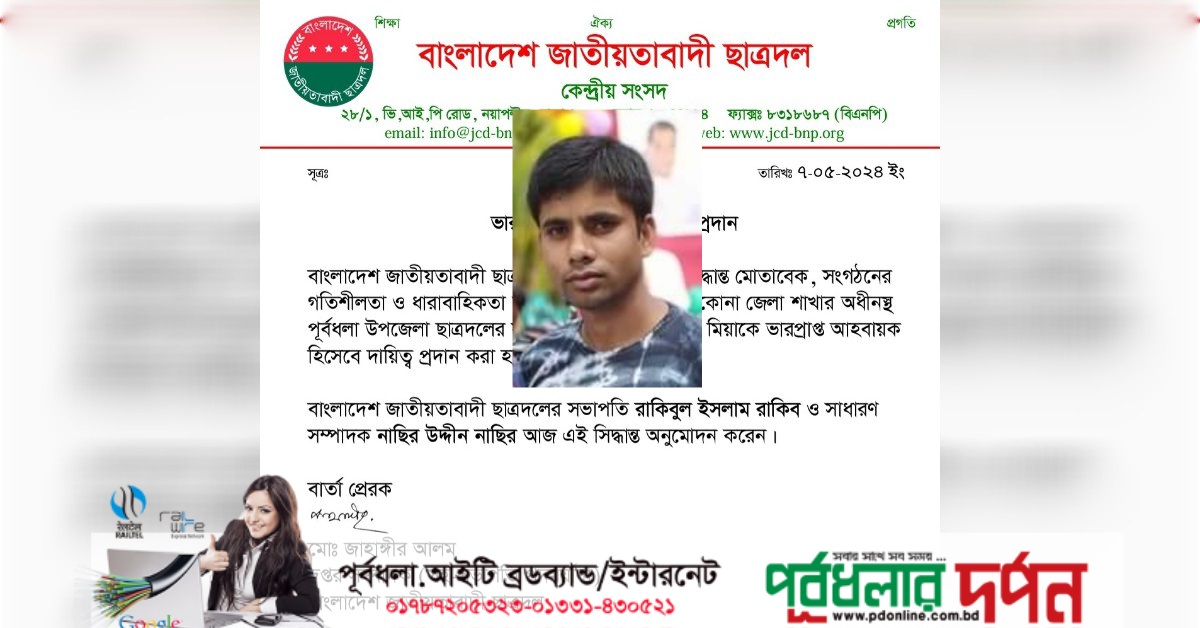

পূর্বধলা উপজেলা ছাত্রদলের ভারপ্রাপ্ত আহবায়কের দায়িত্ব পেলেন উজ্জ্বল

পূর্বধলা উপজেলা ছাত্রদলের যুগ্ম আহ্বায়ক উজ্জ্বল মিয়াকে ভারপ্রাপ্ত আহ্বায়কের দায়িত্ব প্রদান। গতকাল মঙ্গলবার(৭ মে) বাংলাদেশ জাতীয়তাবাদী ছাত্রদল কেন্দ্রীয় কমিটির দপ্তর সম্পাদক মোঃ জাহাঙ্গীর আলমের স্বাক্ষরিত […]