চুড়ান্ত ভোটার তালিকা (২৩/০৩/২০২৪) পূর্বধলা সদর ইউনিয়ন পুরো একসাথে ডাউনলোড ওয়ার্ড নং ভোটার এলাকার নাম ডাইনলোড করতে নামের উপর ক্লিক করুণ কোড ১ পূর্বধলা ১৯৪৯ […]

পূর্বধলায় দলিল লিখক সমিতির সভাপতি লিটন সম্পাদক শামীম

নেত্রকোনার পূর্বধলায় ব্যাপক উৎসাহ উদ্দীপনার মধ্য দিয়ে পূর্বধলা সাব-রেজিস্ট্রি অফিসের দলিল লেখক, স্ট্যাম্প ভেন্ডার ও সহকারী দলিল লিখক সমন্বয় সমিতির ত্রি-বার্ষিক নির্বাচন-২০২৪ সম্পন্ন হয়েছে। ত্রি-বার্ষিক […]

পূর্বধলায় প্রার্থীদের সাথে আচরণবিধি প্রতিপালন বিষয়ক মতবিনিময় সভা

৬ষ্ঠ উপজেলা পরিষদ নির্বাচন-২০২৪ উপলক্ষে পূর্বধলা উপজেলার প্রতিদ্বন্দ্বী প্রার্থীদের সাথে আচরণবিধি প্রতিপালন বিষয়ক মতবিনিময় সভা অনুষ্ঠিত হয়েছে। উক্ত মতবিনিময় সভায় পূর্বধলা উপজেলা নির্বাহী অফিসার ও […]

স্বাধীন ফিলিস্তিন রাষ্ট্র প্রতিষ্ঠার দাবিতে পূর্বধলায় পতাকা উত্তোলন

দেশব্যাপী সব শিক্ষাপ্রতিষ্ঠানে একযোগে জাতীয় পতাকার পাশাপাশি ফিলিস্তিনের পতাকা উত্তোলন, ফিলিস্তিনে দখলদার ইসরায়েলি বাহিনীর বর্বর হত্যাযজ্ঞের প্রতিবাদ ও স্বাধীন ফিলিস্তিন রাষ্ট্রের স্বীকৃতির দাবিতে বিশ্বব্যাপী শিক্ষক-শিক্ষার্থী […]

পূর্বধলায় মহিলা ভাইস চেয়ারম্যান পদে আলোচনায় সাফিয়া খাতুন

নেত্রকোনার পূর্বধলায় জমে উঠছে উপজেলা পরিষদ নির্বাচন। প্রতীক বরাদ্দের পরপরই প্রচারণায় ব্যস্ত সময় পার করছেন প্রার্থীরা। তীব্র তাপদাহেও তারা ছুটছেন ভোটারদের কাছে। দিচ্ছেন প্রতিশ্রুতি, নিচ্ছেন […]

“উচ্চ রক্তচাপ নিয়ন্ত্রণ” বিষয়ে পূর্বধলা উপজেলা স্বাস্থ্য কমপ্লেক্সে দিনব্যাপী কর্মশালা অনুষ্ঠিত

নেত্রকোণার পূর্বধলা “উচ্চ রক্তচাপ নিয়ন্ত্রণ” বিষয়ে দিনব্যাপী এক কর্মশালা অনুষ্ঠিত হয়েছে। রবিবার (৫ মে) পূর্বধলা উপজেলা স্বাস্থ্য কমপ্লেক্সের কনফারেন্স রুমে এ কর্মশালা অনুষ্ঠিত হয়। স্বাস্থ্য […]

পূর্বধলায় নিজ ২ কর্মীকে পুলিশে সোপর্দ করলেন সোহেল

নেত্রকোনার পূর্বধলায় নিজ দলের কর্মীদের পুলিশে সোপর্দ করে নজির দেখালেন রোজা ওয়েলফেয়ার ফাউন্ডেশনের চেয়ারম্যান ও ঢাকা মহানগর উত্তর কৃষক লীগের সহ-সভাপতি মাজহারুল ইসলাম সোহেল। তার […]

নির্বাচনী সংবাদ সম্মেলন- মোঃ মজিবুররহমান খান

সারদেশে উপজেলা পরিষদের নির্বাচন চলমান। এরই ধারাবাহিকতায় নেত্রকোনার পুর্বধলা উপজেলা পরিষদ নির্বাচনের মনোনয়ন পত্র দাখিল, বাছাই, প্রত্যাহারের সময় অতিক্রম করেছে।আজ ০২/০৪/২৪ তারিখ নির্বাচনী প্রতীক বরাদ্দ […]

আসাদুজ্জামান নয়নের পক্ষে এগারো চেয়ারম্যানের গণসংযোগ

নেত্রকোনার পূর্বধলা উপজেলা পরিষদ নির্বাচনে চেয়ারম্যান পদপ্রার্থী আসাদুজ্জামান নয়নের সমর্থনে গণসংযোগ করছেন এগারো ইউনিয়ন পরিষদ চেয়ারম্যানগণ। বুধবার (১ মে) দুপুরে পূ্র্বধলা বাজারে প্রচার প্রচারণা করেন […]

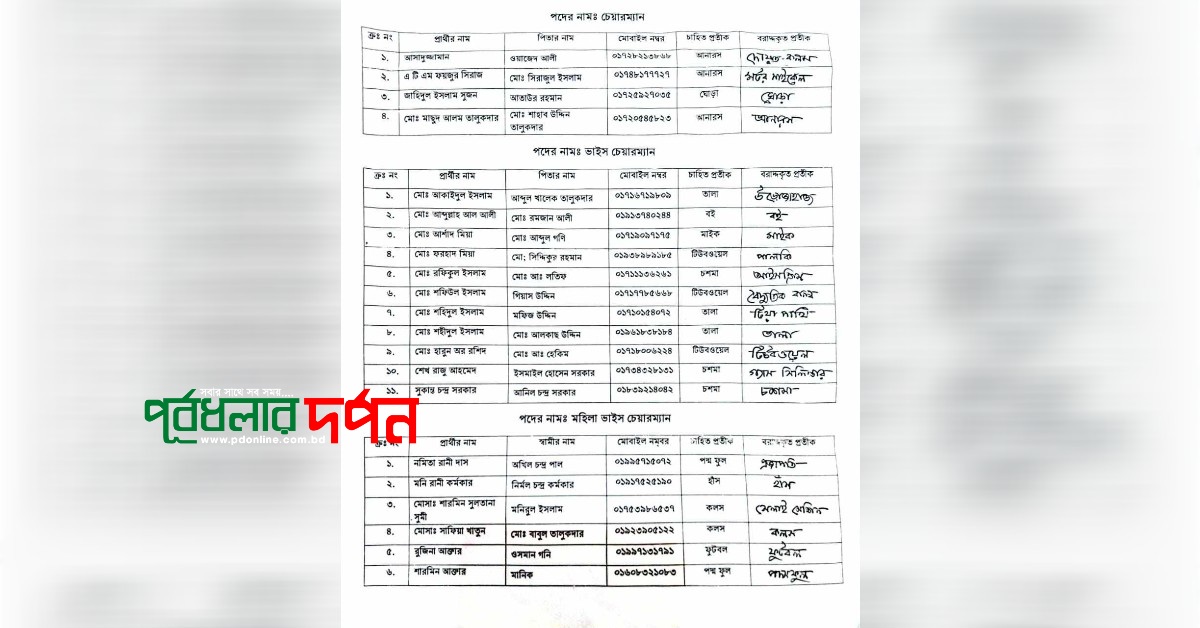

পূর্বধলা উপজেলা পরিষদ নির্বাচনে তিন পদে ২১ প্রার্থীর প্রতীক বরাদ্দ

নেত্রকোণার পূর্বধলায় ৬ষ্ঠ উপজেলা পরিষদ নির্বাচনে অংশগ্রহনের জন্য আজ বৃহস্পতিবার ২মে বৈধ প্রার্থীর মাঝে প্রতিক বরাদ্দ করেন। উপজেলা চেয়ারম্যান পদে ৪জন প্রার্থী বর্তমান চেয়ারম্যান ও […]

পূর্বধলা সড়ক পরিবহণ শাখার উদ্যোগে মহান মে দিবস পালিত

“দুনিয়ার মজদুর এক হও, এক হও” এই স্লোগানকে সামনে রেখে শ্রমিকের দাবি আদায় ও অধিকার প্রতিষ্ঠার লক্ষ্যে নেত্রকোনার পূর্বধলায় বুধবার বিভিন্ন কর্মসূচির মধ্য দিয়ে পালিত […]