বিশ্ব পরিবেশ দিবস উপলক্ষে বৃক্ষরোপণ কর্মসূচি পালন করেছে বাংলাদেশ ছাত্রলীগ পূর্বধলা উপজেলার আগিয়া ইউনিয়ন শাখা। আজ শুক্রবার (৫ জুন) পূর্বধলা উপজেলার আগিয়া ইউনিয়নে পূর্বধলা উপজেলা…

Posts published in “প্রচ্ছদ”

নেত্রকোনার পূর্বধলায় সাবেক ছাত্রলীগ নেতা মরহুম জাহাঙ্গীর আলমের রুহের মাগফিরাত কামনা করে মসজিদে মসজিদে মিলাদ ও দোয়া মাহফিল অনুষ্ঠিত হয়েছে। পূর্বধলা উপজেলা পরিষদ চেয়ারম্যান জাহিদুল…

নেত্রকোনা পূর্বধলায় ০৪ জুন বৃহস্পতিবার সন্ধ্যা ৭টার দিকে উপজেলা সদরের হাসপাতাল গেইটের দক্ষিনপাশে পূর্বশত্রুতার জেরে বাকিবিল্লা (২৬) নামের এক যুবককে কুপিয়ে আহত করেছে দুর্বত্তরা। আহত…

নেত্রকোনা পূর্বধলা সদরের বিভিন্ন এলাকায় করোনা ভাইরাস প্রাদুর্ভাব বিস্তার রোধে স্বাস্থ্যবিধি পালন বিষয়ে অভিযান পরিচালনা করা হয়। আজ ২ জুন মঙ্গলবার দুপুরে মাস্ক না পড়ার…

করোনা ভাইরাস সংক্রমণ পরিস্থিতিতে স্বাস্থ্যবিধি ও সামাজিক দূরত্ব অনুসরণসহ নানাবিধ কারণে দেশের মসজিদগুলাতে মুসল্লিরা স্বাভাবিকভাবে ইবাদত করতে পারছে না। এতে দানসহ অন্যান্য সাহায্য কমে যাওয়ায়…

নেত্রকোণার পূর্বধলা সদর উপজেলার বিভিন্ন কাঁচা-পাকা সড়কে চলছে ধানের খড় শুকানোর কাজ। এতে করে একদিকে রাস্তা যেমন মারাত্মকভাবে ক্ষতিগ্রস্থ হচ্ছে তেমনি বৃদ্ধি পেয়েছে সড়ক দূর্ঘটনার…

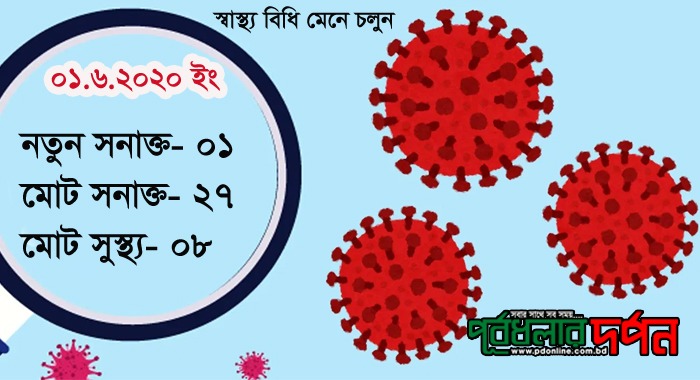

নেত্রকোণা পূর্বধলায় ৩১ মে ৪ জন সনাক্তের পর আজ ০১ জুন করোনা ভাইরাসে আরো ১ জন আক্রান্ত হয়েছেন। এ নিয়ে উপজেলায় মোট ২৭ জন করোনায়…

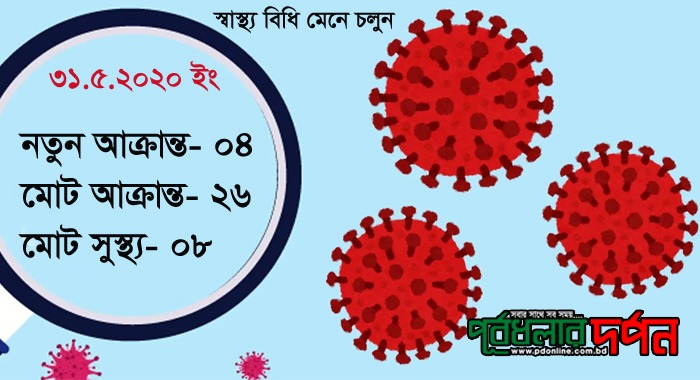

নেত্রকোনা পূর্বধলায় সিভিল সার্জন সূত্রে জানাযায় ৪ জন করোনায় আক্রান্ত হয়েছেন। তথ্যটি ৩১মে প্রকাশের কথা থাকলেও তা প্রকাশ করা আজ ০১ জুন সকালে। আক্রান্তরা পূর্বধলা…

করোনাভাইরাস প্রাদুর্ভাবে সৃষ্ট সংকটে দেশের অসহায়, দুস্থ, দরিদ্র ও কর্মহীন মানুষের জন্য প্রধানমন্ত্রীর ত্রাণ ও কল্যাণ তহবিলে মুক্তিযোদ্ধাদের প্রাপ্ত ভাতার উৎস থেকে ৩ লক্ষ টাকার…

নেত্রকোনা পূর্বধলা উপজেলায় আনুষ্ঠানিকভাবে জাতীয় মহিলা সংস্থা উপজেলা শাখার চেয়ারম্যান এর দায়িত্ব গ্রহণ করেন মনি কর্মকার। গতকাল ৩১ মে (রবিবার) তিনি দায়িত্ব বুঝে নেন। তিনি…

নেত্রকোণা জেলার পূর্বধলা উপজেলায় আওয়ামী যুবলীগের রাজনীতিতে অনেক বহিরাগত, স্বার্থন্বেষী, সেল্ফিবাজ ও যারা শুধু টাকার বিনিময়ে জেলা-উপজেলাসহ বিভিন্ন কমিটির গুরুত্বপূর্ণ পদে পদায়িত হয়ে গেছেন বর্তমানে।…