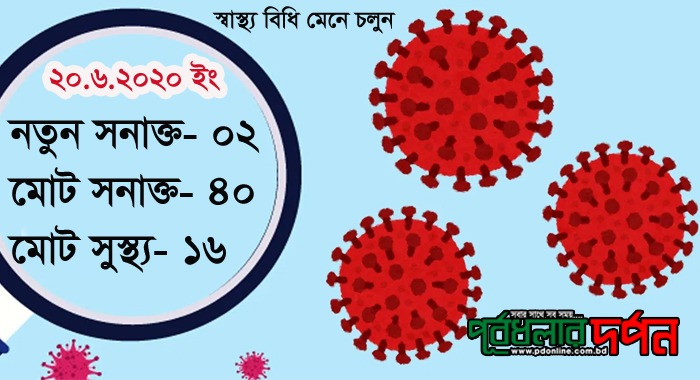

নেত্রকোনা পূর্বধলায় আজ ২০ জুন শনিবার সিভিল সার্জন সূত্রে জানাযায় ০২ জন করোনায় আক্রান্ত হয়েছেন। তারা ২ জনই গোহালাকান্দা ইউনিয়নের শ্যামগঞ্জ এর পুলিশ ফাড়ী সংলগ্ন।…

Posts published in “প্রচ্ছদ”

নেত্রকোণার পূর্বধলা স্টেশন বাজারের বিশিষ্ট্য ব্যবসায়ী আকরম হোসেন আর নেই। তিনি পূর্বধলা এসি ক্লাবের সদস্য মোঃ অলি আহাম্মেদের পিতা এবং রক্তমিতা ফোরাম কেন্দ্রীয় কমিটির মিডিয়া…

নেত্রকোণার পূর্বধলায় সামাজিক দুরত্ব ও স্বাস্থ্যবিধি না মেনেই কর্মী সভা করেছেন বলে অভিযোগ উঠেছে জাতীয়তাবাদী গণতান্ত্রিক আন্দোলন (এনডিএম) কেন্দ্রীয় কমিটির সদস্য মারুফ রহমান মাসুম ।…

নেত্রকোনা পূর্বধলায় আজ বৃহস্পতিবার (১৮ জুন) বিকেল এ কাপাশিয়ায় ছাত্র কল্যাণ সংঘ রাঙ্গামাটিয়া নামে সংগঠনটি সামাজিক দুরত্ব বজায় রেখে এই মানববন্ধন কর্মসূচী পালন করে। মানববন্ধন…

নেত্রকোণার পূর্বধলায় রাতের বেলায় পুকুরে কাজ করতে গিয়ে বাবা ছেলের মর্মান্তিক মৃত্যু হয়েছে। ঘটনাটি ঘটেছে বুধবার ১৭ জুন উপজেলার জালশুকা গ্রামে রাত আনুমানিক ৪টার দিকে।…

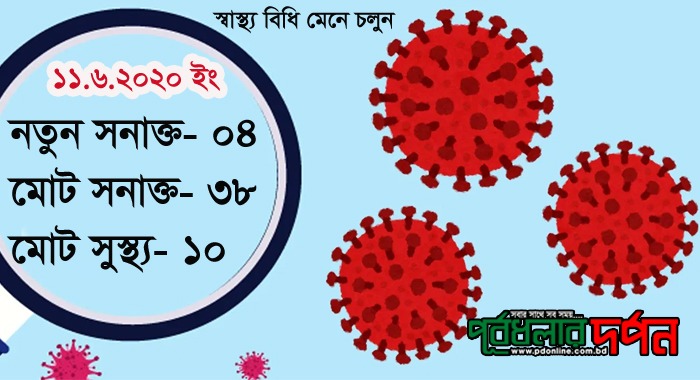

নেত্রকোনা পূর্বধলায় আজ ১১ জুন বৃহস্পতিবার সিভিল সার্জন সূত্রে জানাযায় ০৪ জন করোনায় আক্রান্ত হয়েছেন। তারা ৪ জনই গোহালাকান্দা ইউনিয়নের শ্যামগঞ্জ এর মাষ্টার পাড়া,খাসপাড় ও…

নেত্রকোনার পূর্বধলায় ট্রাকের নিচে চাপা পড়ে মোঃ কালাম মিয়া (৪০) নামের এক ব্যক্তি নিহতর ঘটনায় আজ ৬ জুন শনিবার সন্ধ্যা সাতটায় পুলিশ ঘাতক ট্রাক চালক…

নেত্রকোণার পূর্বধলায় ট্রাকের চাপায় মোঃ কালাম (৪০) নামে এক ব্যক্তি নিহত হয়েছেন। আজ শনিবার (৬ জুন) বিকালে উপজেলার শ্যামগঞ্জ-জারিয়া সড়কের জাওয়ানী মসজিদের সামনে এ দুর্ঘটনা…

নেত্রকোনা পূর্বধলায় সিভিল সার্জন সূত্রে জানাযায় ৭ জন করোনায় আক্রান্ত হয়েছেন। এছাড়া ২ ফলোআপ টেষ্টে পিজিটিভ এসেছে। তথ্যটি আজ ৫ জুন শুক্রবার রাত ১১ দিকে…

দ্বি-জাতি তত্ত্বের ভিত্তিতে ১৯৪৭ সালে পাকিস্থান নামক রাষ্ট্রের জন্ম হলেও পূর্ব পাকিস্থানের জনসাধারণের স্বপ্ন ভঙ্গের শুরু সেদিন থেকেই। বাঙালি চেতনায় প্রথম আঘাত শুরু হয় ভাষার…

নেত্রকোনা পূর্বধলায় সিভিল সার্জন সূত্রে জানাযায় ৭ জন করোনায় আক্রান্ত হয়েছেন। এছাড়া ২ ফলোআপ টেষ্টে পিজিটিভ এসেছে। তথ্যটি আজ ৫ জুন শুক্রবার রাত ১১ দিকে…