করোনার প্রভাবে এখন সর্বত্রই সামাজিক, অর্থনৈতিক অস্থিরতা বিরাজ করছে। মাননীয় প্রধানমন্ত্রী জনগণের পাশে থেকে দূর্যোগ মোকাবেলায় একের পর এক জনবান্ধব কর্মসূচী দিয়ে যাচ্ছেন। এতে চেষ্টার…

Posts published in “প্রচ্ছদ”

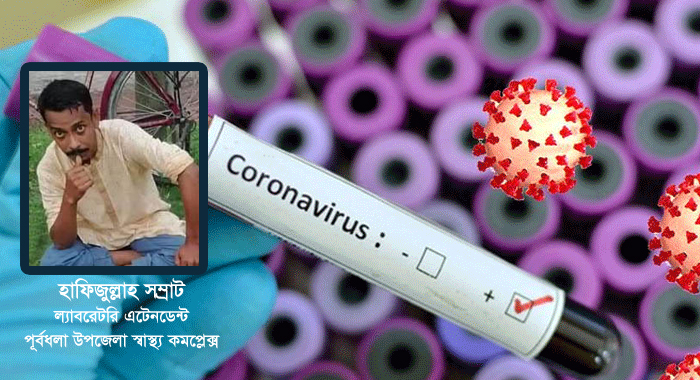

মোহাম্মদ আলী জুয়েল: সম্রাট আমার বাল্যবন্ধু, প্রতিবেশী, সহপাঠী আবার কখনো অভিভাবক। বলতেই হচ্ছে বন্ধু, তুমি দ্রুত সুস্থ হও। তোমাকে আমাদের পূর্বধলাবাসীর খুব প্রয়োজন। তুমি সুস্থ…

নেত্রকোনা পূর্বধলায় আজ ০১ জুলাই বুধবার সিভিল সার্জন সূত্রে জানা যায়, ০৩ জন করোনায় সনাক্ত হয়েছেন। সনাক্ত ব্যক্তিরা পূর্বধলা স্বাস্থ্য কমপ্লেক্স এর একজন এমটি(ইপিআই)হেলেনা আক্তার…

নেত্রকোনার পূর্বধলায় করোনা ভাইরাস প্রতিরোধে উপজেলা প্রশাসনের উদ্যোগে মসজিদ, মন্দির, মাজারসহ ধর্মীয় উপাসনালয় ও জরুরি সেবা কাজে নিয়োজিত দপ্তরসহ মোট ১৫০টি প্রতিষ্ঠানে স্বাস্থ্য সুরক্ষা সামগ্রী…

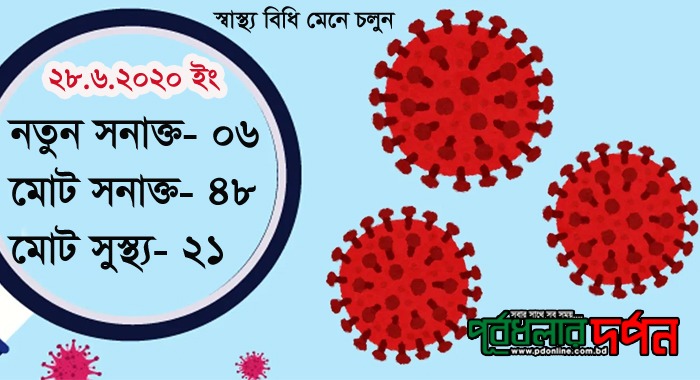

নেত্রকোনা পূর্বধলায় আজ ২৮ জুন রবিবার সিভিল সার্জন সূত্রে জানা যায়, পূর্বধলা উপজেলা স্বাস্থ্য কমপ্লেক্স এর ইউ.এইচ এন্ড এফ.পিও (THO) ডা. মাহমুদা আক্তারসহ মোট ৬জন…

নেত্রকোনা পূর্বধলায় আজ ২৬ জুন শুক্রবার সিভিল সার্জন সূত্রে জানা যায়, ০১ জন করোনায় আক্রান্ত হয়েছেন। আক্রান্ত ব্যক্তি আগিয়া ইউনিয়নের আশিকুর রহমান (২৬)। এ নিয়ে…

গারো জনগোষ্ঠীর জীবন সংগ্রামের সঙ্গে আন্দোলন-সংগ্রাম জড়িয়ে আছে সেই আদিমকাল থেকেই। যুগযুগ ধরে যাযাবরের মত জীবন যাপন করেছে গারো সমাজ। তাই তাদের বিভিন্ন স্থানে বসবাস…

নেত্রকোনায় পূর্বধলা উপজেলার সদর ও আশেপাশের জনগন গত মঙ্গলবার (২৩ জুন) থেকে ডিস সেবা থেকে বঞ্চিত। দর্শকেরা যে কোনো মুহূর্তে বিশ্বের যে কোনো স্থানে ঘটে…

নেত্রকোনার পূর্বধলায় আজ আরো এক জনের করোনা পরীক্ষায় পজিটিভ এসেছে। রি-টেষ্ট এ পজিটিভ এক। নতুন আক্রান্তকৃত ব্যক্তি হলেন, তোফাজ্জল হোসেন (বাদশা) জারিয়া দক্ষিন পাড়া হাজ্বী…

নেত্রকোনা পূর্বধলায় এ পর্যন্ত মহামারী করোনা ভাইরাসে আক্রান্ত হয়েছেন ৪০ জন এর মধ্যে সুস্থ্য হয়েছেন ১৬ জন। আক্রান্ত ব্যক্তিদের হোম আইসোলেশন এ থাকার কথা থাকলেও…

নেত্রকোনা পূর্বধলা সদরের বিভিন্ন এলাকায় করোনা ভাইরাস প্রাদুর্ভাব বিস্তার রোধে স্বাস্থ্যবিধি পালন বিষয়ে অভিযান পরিচালনা করা হয়। আজ ২২ জুন সোমবার দুপুরে মাস্ক না পড়ার…