নেত্রকোনা জেলার পূর্বধলা উপজেলার আগিয়া ইউনিয়নের বাট্রা বাজার থেকে খাদ্যবান্ধব কর্মসূচির নয় বস্তা সরকারি চাল জব্দের ঘটনা ঘটে গত ২৭ মে (বুধবার)। আগিয়া ইউনিয়নে খাদ্য…

Posts published in “প্রচ্ছদ”

নেত্রকোণা পূর্বধলায় ৩০ মে (শনিবার) বিশকাকুনী ইউনিয়নের ধলা গ্রামে নিজ বাড়ীতে কেন্দ্রীয় নেতা বিভিন্ন গণমাধ্যম প্রতিনিধিদের সাথে আলোচনায় সরকার গৃহীত কার্যক্রমের সুফল সর্বসাধারণের কাছে পৌঁছে…

নেত্রকোনার পূর্বধলা উপজেলার বাট্রা বাজার থেকে খাদ্যবান্ধব কর্মসূচির সেই ৯ বস্তা সরকারি চাল পুলিশ জব্দের পর ঘটনার সাথে জড়িত প্রকৃত দোষীদের চিহিৃত ও শাস্তির দাবীতে…

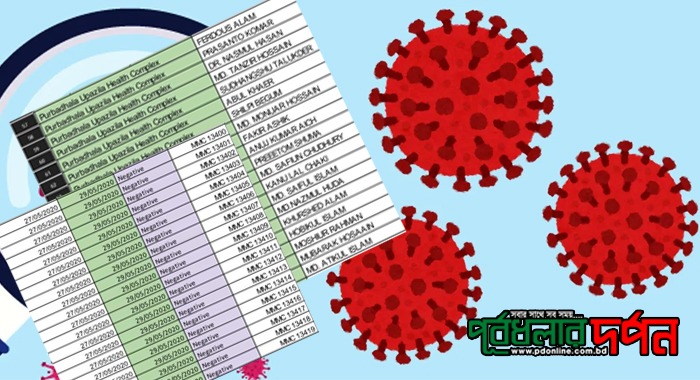

নেত্রকোণা পূর্বধলায় করোনা পজিটিভ আসা ব্যক্তিদের ২য় টেস্টের তালিকা প্রকাশ করলো ২৯মে শুক্রবার রাতে নেত্রকোণা সিভিল সার্জন অফিস। এর মধ্যে জগৎমনি সরকারি পাইলট উচ্চ বিদ্যালয়ের…

পূর্বধলায় জব্দকৃত চালের সাথে জড়িতদের খোঁজে তদন্তে প্রশাসন নির্বাহী অফিসার জানান প্রমাণিত হলে দোষীদের শাস্তির আওতায় আনা হবে নেত্রকোনার পূর্বধলা উপজেলায় গতকাল ২৭ মে (বুধবার)…

নেত্রকোনা পূর্বধলা সরকারী কলেজ একাদশ শ্রেণীর ছাত্র জোবায়ের সরকার নামে এক ছাত্রকে ঈদের আগের দিন সন্ধ্যার পর জেলার তারাকান্দা উপজেলায় কামারগাঁও ইউনিয়নের কালিখা গ্রামে হত্যার…

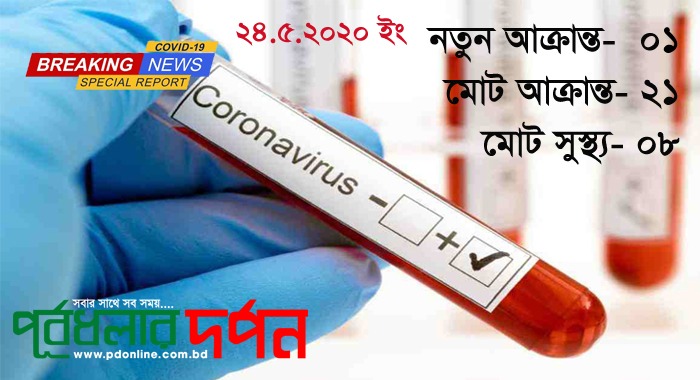

নেত্রকোনা পূর্বধলায় আজ ২৪মে করোনা ভাইরাসে আক্রান্ত হলে উপজেলা সহ. শিক্ষা অফিসার, তথ্যটি নিশ্চিত করেছে নেত্রকোনা সিভিল সার্জন। এ নিয়ে পূর্বধলা আক্রান্ত দাড়াল ২১ এর…

নেত্রকোনার পূর্বধলায় কর্মরত সাংবাদিকদের ঈদ উপহার প্রদান করেছেন উপজেলা পরিষদ চেয়ারম্যান জাহিদুল ইসলাম সুজন। পবিত্র ঈদ-উল-ফিতরের শুভেচ্ছা ও মোবারকবাদ জানিয়ে তিনি এই উপহার প্রদান করেন।…

প্রিয় পূর্বধলাবাসী, আসসালামু আলাইকুম। দীর্ঘ একমাস সিয়াম সাধনার পর আমাদের মাঝে আনন্দের বার্তা নিয়ে এসেছে ইসলাম ধর্মাবলম্বীদের সবচেয়ে বড় আনন্দ পবিত্র ঈদুল ফিতর। পবিত্র ঈদুল…

ঈদুল ফিতর উপলক্ষে পূর্বধলাবাসী সহ সবার প্রতি ঈদের শুভেচ্ছা জানিয়ে বিবৃতি দিয়েছেন মাজহারুল ইসলাম সোহেল. সহ-সভাপতি ঢাকা মহানগর উত্তর কৃষকলীগ ও চেয়ারম্যান রোজা ফাউন্ডেশন। পবিত্র…

লন্ডন যুবলীগের সহ-সভাপতি নেত্রকোণা-৫ আসনের এমপি পদপ্রার্থী ইঞ্জি.তুহিন আহাম্মদ খান দেশবাসীসহ পূর্বধলার সমস্ত মুসলিম উম্মাহকে পবিত্র ঈদুল ফিতরের শুভেচ্ছা জানান। আজ এক শুভেচ্ছা বার্তায় ইঞ্জি.তুহিন…