নেত্রকোণার পূর্বধলায় এলজিএডি’র বাস্তবায়নে জিওবি ২০২২-২৩ প্রোগ্রামের আওতায় ১২শ’ মিটার রাস্তা উপজেলা স্টেশন বাজার হইতে পূর্বধলা বাজার পর্যন্ত জিসি রোডটি ১ কোটি ৫৭ লক্ষ ৪৫২ […]

পূর্বধলায় জমি সংক্রান্ত বিরোধে এক ব্যক্তিকে নৃশংসভাবে হত্যা

নেত্রকোনার পূর্বধলায় জমি নিয়ে বিরোধের জেরে ইদ্রিস আলী (৬৫) নামে এক বৃদ্ধকে নৃশংসভাবে কুপিয়ে হত্যা করা হয়েছে। গত রোববার (২৭ আগস্ট) সন্ধায় রাজধলা বিলের পশ্চিমে […]

পূর্বধলায় মোড়ক উন্মোচন হলো কংস’ স্মরণিকার

নেত্রকোণার পূর্বধলায় জাতীয় শোক দিবস উপলক্ষে আলোচনা সভা ও পূর্বধলা রিপোর্টার্স ক্লাবের ধারাবাহিক ‘কংস’ স্মরণিকার ৩য় প্রকাশনার মোড়ক উন্মোচন অনুষ্ঠান শনিবার (১৯ আগষ্ট) পূর্বধলা সরকারি […]

পূর্বধলায় যথাযথ মর্যাদায় জাতীয় শোক দিবস পালিত

নেত্রকোণার পূর্বধলায় গতকাল মঙ্গলবার বঙ্গবন্ধু শেখ মুজিবুর রহমানের ৪৮তম শাহাদাত বার্ষিকী ও জাতীয় শোক দিবস পালিত হয়েছে। এ উপলক্ষে আওয়ামীলীগ, যুবলীগ, কৃষকলীগ, শ্রমিকলীগ, স্বেচ্ছাসেবকলীগ, তাঁতীলীগ, […]

আজকের আরবানের মতবিনিময় সভা

গণপ্রজাতন্ত্রী বাংলাদেশ সরকারের তথ্য ও সম্প্রচার মন্ত্রণালয় কর্তৃক নিবন্ধিত অনলাইন নিউজ পোর্টাল আজকের আরবানের আয়োজনে গত শনিবার সন্ধায় এক মতবিনিময় সভায় অনুষ্ঠিত হয়েছে। পত্রিকাটির নিবন্ধন […]

ব্লগার আসাদ নুরের ফাঁসির দাবিতে পূর্বধলায় মানবন্ধন

মহানবী হযরত মুহাম্মাদ রসুল ( স:) সম্পর্কে কটুক্তি ও অসালীন মন্তব্য করায় ব্লগার আসাদ নূরের দৃষ্টান্তমূলক শাস্তির দাবীতে নেত্রকোনার পূর্বধলায় মানববন্ধন অনুষ্ঠিত হয়েছে। রবিবার (১৩ […]

পূর্বধলায় পোনা মাছ অবমুক্তকরণ, আশ্রয়ণ প্রকল্পের উপকারভোগীদের শুকনো খাবার ও বীজ বিতরণ

নেত্রকোনার পূর্বধলায় ২০২৩-২৪ অর্থবছরে মৎস্য অধিদপ্তরের রাজস্ব খাতের আওতায় অভ্যন্তরীণ জলাভূমি, বর্ষাপ্লাবিত ধানক্ষেত প্লাবনভূমি ও প্রাতিষ্ঠানিক জলাশয়ে উপজেলার ঐতিহাসিক রাজধলা বিলে পোনা মাছ অবমুক্ত করা […]

পূর্বধলায় সরকারি হালটে রাস্তা বন্ধ করে ঘর নির্মাণ; অবরুদ্ধ ১৪ পরিবার

নেত্রকোনার পূর্বধলা উপজেলার আগিয়া ইউনিয়নের মহিষবেড় গ্রামের মইজ উদ্দিন নামে এক ব্যক্তির বিরুদ্ধে প্রতিবেশীদের সরকারি হালট দিয়ে চলাচলের রাস্তা বন্ধ করে ঘর নির্মাণের অভিযোগ ওঠেছে। […]

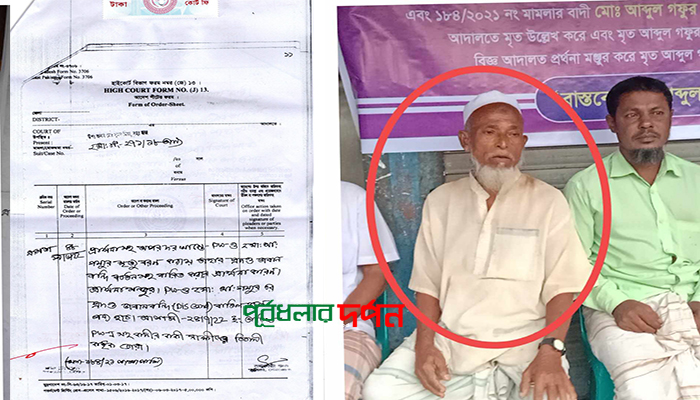

পূর্বধলায় ১ বছর আগে মৃত দেখানো আব্দুল গফুর এখনও জীবিত

গ্রামের সকলের সাথে হাসি-খুশি, সুস্থ জীবন যাপন করলেও আদালতের প্রতিবেদনে মো. আ. গফুরকে দেখানো হয়েছে মৃত! অবিশ্বাস্য ঘটনাটি ঘটেছে নেত্রকোণা জেলার পূর্বধলা উপজেলার বিশকাকুনি ইউনিয়নের […]

পূর্বধলায় ট্রেনের ধাক্কায় এক বৃদ্ধা নিহত

নেত্রকোনার পূর্বধলায় ট্রেনের ধাক্কায় অজ্ঞাত বৃদ্ধা (৬১) এর মৃত্যু হয়েছে। গত বুধবার বাড়হা জেলেপাড়ায় এলাকায় ময়মনসিংহগামী ২৭১ আপ ট্রেনের ধাক্কা লেগে আহত হয়। এরপর খবর […]

পূর্বধলায় অজ্ঞাত ভারসাম্যহীন এক নারীর মৃত্যু

নেত্রকোনা জেলার পূর্বধলা উপজেলার জারিয়া ইউনিয়নের ঢেওটুকোন বাজারে অজ্ঞাত ভারসাম্যহীন এক নারীর মৃত্যুর খবর পাওয়া গেছে। স্থানীয় ও পূলিশ সূত্রে জানা যায় আজ (৫ ই […]