নেত্রকোনার পূর্বধলা সরকারি কলেজের রাষ্ট্রবিজ্ঞান বিভাগের সাবেক অধ্যাপক মাহফিজ উদ্দিন ইন্তেকাল করেছেন (ইন্না লিল্লাহি ওয়া ইন্না ইলাইহি রাজিউন)।রবিবার (১৩ জুলাই) সকাল সাড়ে ৮টায় রাজধানীর ঢাকা […]

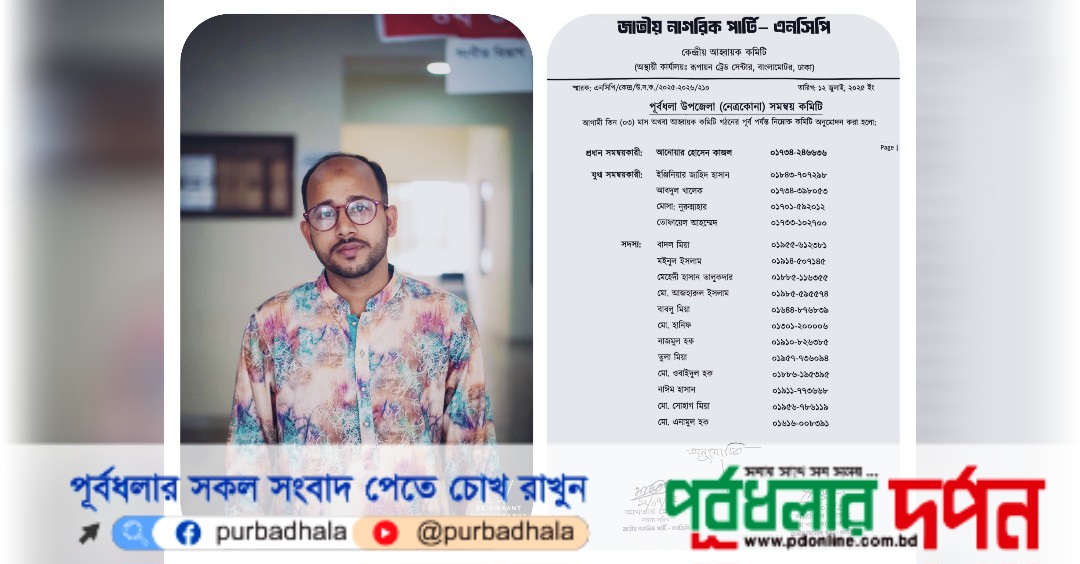

নতুন কমিটি, পুরনো প্রশ্ন—পূর্বধলায় এনসিপি কমিটি নিয়ে সামাজিক মাধ্যমে তোলপাড়

নেত্রকোনার পূর্বধলায় জাতীয় নাগরিক পার্টির (এনসিপি) ৩১ সদস্যবিশিষ্ট সমন্বয় কমিটি ঘোষণা করা হলেও, কমিটিকে ঘিরে শুরু হয়েছে সামাজিক যোগাযোগমাধ্যমে বিতর্ক। শুক্রবার (১২ জুলাই) কেন্দ্রীয় কমিটির […]

দমদমা কালিগঞ্জ সামাজিক সংগঠনের মানবিক যাত্রা

শেরপুর জেলা সদর এর পৌরসভার ৮ নং ওয়ার্ড দমদমা কালিগঞ্জ এলাকায় গড়ে উঠেছে এক ব্যতিক্রমধর্মী মানবিক উদ্যোগ — দমদমা কালিগঞ্জ সামাজিক সংস্থা । এই সংস্থার […]

পূর্বধলায় সামাজিক ক্ষমতায়ন ও আইনি সুরক্ষা কর্মসূচি অনুষ্ঠিত

“থাকবো নাকো বদ্ধ ঘরে” প্রতিপাদ্যকে সামনে নিয়ে নেত্রকোণার পূর্বধলায় এনজিও ব্র্যাকের উদ্যোগে আজ (২১জুন) শনিবার সামাজিক ক্ষমতায়ন ও আইনি সুরক্ষা কর্মসূচি পালিত হয়েছে। ১৩ থেকে […]

সহযোগী অধ্যাপক পদে পদোন্নতি পেলেন পূর্বধলার ফরহাদ আহমেদ

জগন্নাথ বিশ্ববিদ্যালয়ের দর্শন বিভাগের সহকারী অধ্যাপক জনাব ফরহাদ আহমেদ (শফি) সম্প্রতি একই বিভাগে সহযোগী অধ্যাপক হিসেবে পদোন্নতি লাভ করেছেন। বিশ্ববিদ্যালয়ের ১০১তম সিন্ডিকেট সভায় গত ২ […]

পূর্বধলা বুথে টাকার হাহাকার, ভোগান্তিতে সাধারণ গ্রাহক

ঈদুল আযহার টানা ছুটির মধ্যে পূর্বধলার কার্যকর এটিএম বুথে নগদ টাকার সঙ্কট দেখা দিয়েছে। ফলে ঈদের কেনাকাটা, জরুরি চিকিৎসা ও দৈনন্দিন ব্যয়ের জন্য ভোক্তারা পড়েছেন […]

পূর্বধলায় দুর্যোগ ব্যবস্থাপনায় জরুরী সাড়াদান শক্তিশালীকরণ কর্মশালা অনুষ্ঠিত

নেত্রকোণার পূর্বধলায় উপজেলা দুর্যোগ ব্যবস্থাপনা কমিটির সদস্যদের এসওডি এর আলোকে দুর্যোগ ব্যবস্থাপনায় জরুরী সাড়াদান পদ্ধতি শক্তিশালীকরণ বিষয়ক প্রশিক্ষণ কর্মশালা অনুষ্ঠিত হয়েছে। আজ বৃহস্পতিবার (২৯ মে) […]

পূর্বধলায় মটরসাইকেল চালককে গলা কেটে হত্যা মটরসাইকেল ছিনতাই

নেত্রকোণার পূর্বধলায় রুবেল মিয়া (২৭) নামের এক চালককে হত্যা করে মোটরসাইকেল ছিনতাই করেছে দুর্বৃত্তরা। বৃহস্পতিবার বিকালে উপজেলার জারিয়া ইউনিয়নের ছনধরা গ্রামের বিলের পাশে একটি ধান […]

পূর্বধলা হাসপাতালে ৪ দফা দাবি নিয়ে রেডলাইন সেইফ রাইডার্স ক্লাব

নেত্রকোনার পূর্বধলা উপজেলা স্বাস্থ্য কমপ্লেক্সে সেবার মানোন্নয়নের দাবিতে স্মারকলিপি দিয়েছে স্থানীয় সংগঠন রেডলাইন সেইফ রাইডার্স ক্লাব। আজ মঙ্গলবার দুপুরে ক্লাবের পক্ষ থেকে উপজেলা স্বাস্থ্য ও […]

পূর্বধলায় পুলিশের বিরুদ্ধে চুরিতে ব্যবহৃত ভ্যানগাড়ী ও চোর ছেড়ে দেওয়ার অভিযোগ

আমিনুল হকঃ নেত্রকোণা পূর্বধলায় গত ২৩ মার্চ রাতে টহলরত পূর্বধলা থানা পুলিশ কর্তৃক সন্দেহজনকভাবে একটি লোহার পাইপ (পাইলিং পাইপ) ভ্যানগাড়িসহ উপজেলা পরিষদের মূল গেটের পাশে […]

গার্ডস কাউন্সিল ময়মনসিংহ শাখার সম্পাদক পূর্বধলার আব্দুল্লাহ আল নোমান

বাংলাদেশ রেলওয়ে গার্ডস কাউন্সিল ময়মনসিংহ শাখার ত্রি-বার্ষিক নির্বাচন অনুষ্ঠিত হয়েছে। এতে মো. মজিবুল হাসান রবিনকে সভাপতি, আব্দুল্লাহ আল নোমানকে সম্পাদক ও আনিসুর রহমানকে অর্থ সম্পাদক […]