পূর্বধলায় আজ ১৫ এপ্রিল বুধবার করোনা ভাইরাস (কোভিড-১৯) আক্রান্ত সন্দেহে দুই ইউনিয়নের আট জনের নমুনা সংগ্রহ করা হয়েছে। পূর্বধলা উপজেলা স্বাস্থ্য কমপ্লেক্সের একটি বিশেষ দল…

Posts published in “প্রচ্ছদ”

নেত্রকোনা পূর্বধলা আজ ১৫ এপ্রিল সকালে ময়মনসিংহের তারাকান্দা উপজেলার কালিখা থেকে তিনটি মোটরসাইকেল করে ৪ বস্তা চাল নিয়ে পূর্বধলার দিকে আসছিল, এ সময় উপজেলার হোগলা…

নেত্রকোনা পূর্বধলায় আজ মঙ্গলবার ১৪ এপ্রিল জারিয়া ইউনিয়নের তুতিরপাড়া গ্রামে নিজেদের পুকুর পাড়ে চাষ করা লাউ চুরি ঠেকাতে পেতে রাখা বিদ্যুতের ফাঁদে বিদ্যুৎস্পৃষ্ট হয়ে এক…

নেত্রকোনা পূর্বধলায় দেশের উপজেলার সদর ইউনিয়নে রবিবার (১২এপ্রিল) বিকালে পুকুরিয়াকান্দা বনাম ধোপাডহর গ্রামের খেলোয়ারদের মধ্যে এ সংঘর্ষ হয়েছে। গত শনিবার খেলার মাঠে ধোপাডহর টিম জয়ী…

পূর্বধলা উপজেলা প্রশাসনের পক্ষ থেকে দুঃস্থ ও অসহায় মানুষদের ঘরে ঘরে খাদ্য পৌঁছে দেওয়ার কর্মসূচী পরিচালিত হচ্ছে। উপজেলার বিশকাকুনী ইউনিয়নের ধোবারুহী গ্রামের কতিপয় লোকের কাছ…

পূর্বধলায় আজ ১৩ এপ্রিল সোমবার করোনা ভাইরাস (কোভিড-১৯) আক্রান্ত সন্দেহে চারজনের নমুনা সংগ্রহ করা হয়েছে। পূর্বধলা উপজেলা স্বাস্থ্য কমপ্লেক্সের একটি বিশেষ দল সন্দেহভাজন ব্যাক্তিদের নমুনা…

করোনা ভাইরাস মহামারীতে নেত্রকোণার পূর্বধলায় অসহায় ও দুস্থদের মাঝে ময়মনসিংহ মহানগর আওয়ামী লীগের প্রতিষ্ঠাকালীন কার্যনির্বাহী সদস্য ও মুমিনুন্নিসা ফাউন্ডেশন এর ব্যবস্হাপনা পরিচালক আলহাজ্ব আজিজুর রহমান…

পূর্বধলায় আজ ১২ এপ্রিল রবিবার করোনা ভাইরাস (কোভিড-১৯) আক্রান্ত সন্দেহে সাতজনের নমুনা সংগ্রহ করা হয়েছে। পূর্বধলা উপজেলা স্বাস্থ্য কমপ্লেক্সের একটি বিশেষ দল সন্দেহভাজন ব্যাক্তিদের নমুনা…

পূর্বধলায় আজ ১১ এপ্রিল শনিবার করোনা ভাইরাস (কোভিড-১৯) আক্রান্ত সন্দেহে একজনের নমুনা সংগ্রহ করা হয়েছে। পূর্বধলা উপজেলা স্বাস্থ্য কমপ্লেক্সের একটি বিশেষ দল সন্দেহভাজন ব্যাক্তিদের নমুনা…

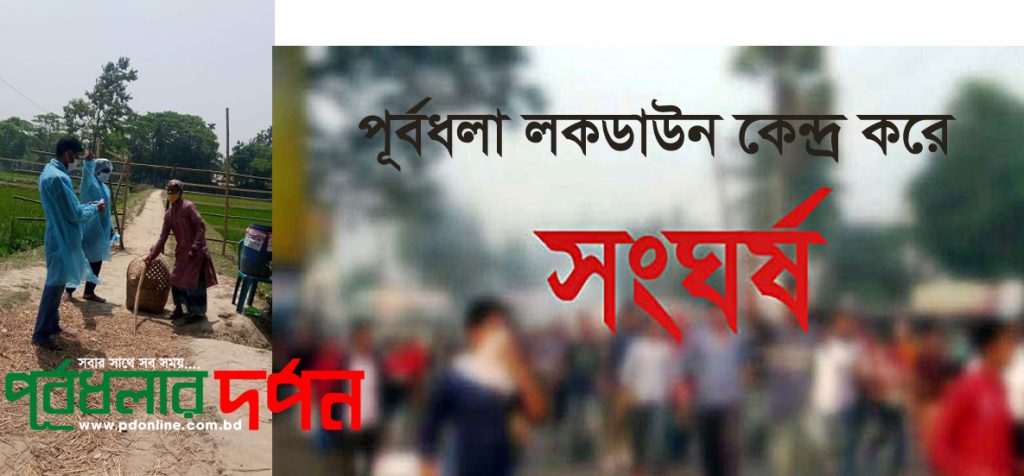

নেত্রকোনা পূর্বধলায় গতকাল (৭এপ্রিল) হতে শুরু হয় সামাজিক লকডাউন কার্যক্রম, এর পরপরই সামাজিক যোগাযোগ মাধ্যমে শুরু হয় সকলের ধন্যবাদ বার্তা। কিন্ত একদিন না যেতেই সেই…

নেত্রকোনা পূর্বধলায় গতকাল বেশকিছু গ্রাম ও সদরের রাস্তা এলাকাবাসী/যুবসমাজ মিলে লকডাউন করেদেয়। এ নিয়ে কিছু কিছু স্থানে সাময়িক সমস্যা হলেও জুগলী গ্রামে সংঘর্ষের রূপ নেয়।…