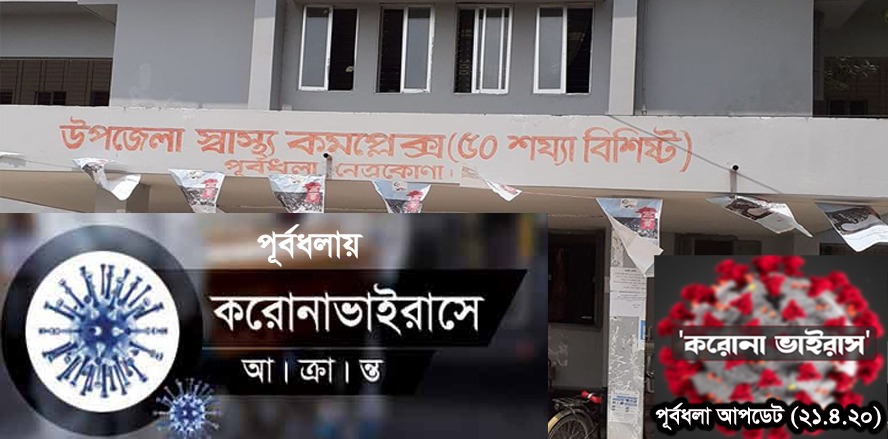

নেত্রকোনা পূর্বধলায় উপজেলা স্বাস্থ্য কমপ্লেক্সের ডা. আজহারুল ইসলাম(MO-DC) ও ডা. ধ্রুব সাহা রায়(MO) এই দুই চিকিৎসকের করোনা সনাক্ত হয়েছে। গত দুইদিন আগে তাদের নমুনা সংগ্রহ…

Posts published in “প্রচ্ছদ”

নেত্রকোনার পূর্বধলায় মন্দিরের তালা ভেঙ্গে দানবাক্সের টাকা ও তৈজসপত্র চুরির ঘটনা ঘটেছে। গত সোমবার (২০ এপ্রিল) দিবাগত রাতে উপজেলার হোগলা গ্রামে সনাতন ধর্মালম্বীদের শ্রী শ্রী…

পূর্বধলায় আজ ২০ এপ্রিল সোমবার করোনা ভাইরাস (কোভিড-১৯) আক্রান্ত সন্দেহে বৈরাটি ইউনিয়নের কাজলা গ্রামের ৪জন পূর্বধলা সদর ১জন ও পূর্বধলা হাসপাতাল কর্মী ৩জনসহ মোট ৮…

নেত্রকোনা পূর্বধলার ঘাগড়া ইউনিয়নের বীর মুক্তিযোদ্ধা শামছুল ইসলামের ৬ ছেলে ও ৩ মেয়ের মধ্যে ৪র্থ ছেলে রাজিবুল ইসলাম রাজিব। এলাকার গরীব দুঃখী মানুষের কাছে এক…

নেত্রকোনার পূর্বধলায় আজ সোমবার (২০ এপ্রিল) বিকেলে কালোবাজারে বিক্রি হওয়া খাদ্যবান্ধব কর্মসূচির ৯ বস্তা সরকারি চাল জব্দ করেছে স্থানীয় লোকজন। উপজেলার ধলামূলগাঁও ইউনিয়নের দেবকান্দা নামক…

বংশাল থানার চৌকস অপারেশন অফিসার এস আই গৌতম রায়ের হত্যাকান্ডের দশ বছর পূর্ন হল। ২০১০ সালের ১৯ শে এপ্রিল অফিসের কাজ শেষ করে রাতে বাসায়…

নেত্রকোনা পূর্বধলায় আজ ১৯ এপ্রিল রবিবার লকডাউন বিধি অমান্য করায় সহকারি কমিশনার (ভূমি) ও নির্বাহী ম্যাজিস্ট্রেট নাসরিন বেগম সেতু এই ভ্রাম্যমান আদালত পরিচালনা করেন। এসময়…

নেত্রকোনা পূর্বধলায় বৈশ্বিক মহামারীতে স্বেচ্ছাসেবী সংগঠন আরবানের উদ্যোগে নাগরিকদের সচেতন করতে চলছে ব্যাপক ভিত্তিক প্রচারাভিযান, সাংবাদিকদের নিয়ে মতবিনিময় সভা, খাদ্যসহায়তা, হ্যান্ড স্যানিটাইজার, মাস্ক বিতরণ, বিভিন্ন…

নেত্রকোনা পূর্বধলায় গতকাল ১৮ এপ্রিল শনিবার ঘাগড়া ইউনিয়নের স্টুডেন্ট ওয়েলফেয়ার এসোসিয়েশন রাঙ্গামাটিয়া (ছাত্র কল্যাণ সংঘ রাঙ্গামাটিয়া) কর্তৃক রাঙ্গামাটিয়া পুরো গ্রামে এবং হিরন্নপট্রি ও কাপাশিয়া গ্রামের…

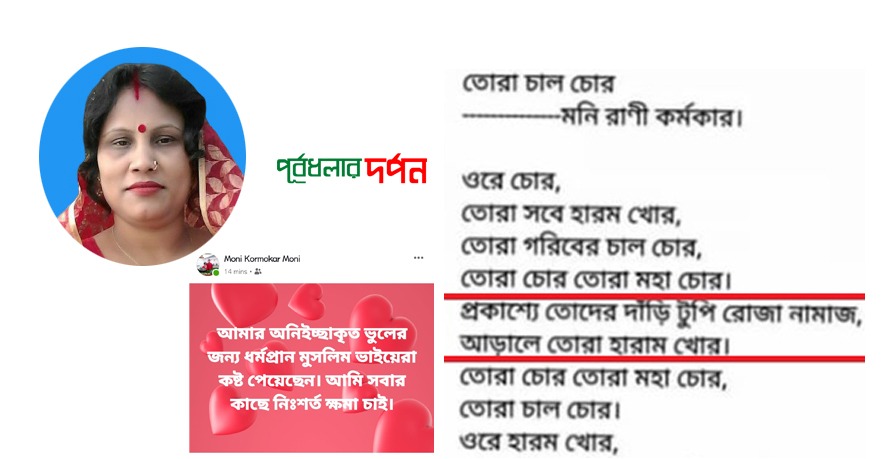

নেত্রকোণার পূর্বধলায় জাতীয় মহিলা সংস্থার নব নির্বাচিত চেয়ারম্যান মনি রানী কর্মকার ধর্মীয় অনুভূতিতে আঘাত দিয়ে কবিতা লিখে সামাজিক যোগাযোগ মাধ্যম ফেসবুকে ভাইরাল হওয়ার পর ব্যাপক…

করোনা ভাইরাস মহামারীতে নেত্রকোণার পূর্বধলায় অসহায় ও দুস্থদের মাঝে ময়মনসিংহ মহানগর আওয়ামী লীগের প্রতিষ্ঠাকালীন কার্যনির্বাহী সদস্য ও মুমিনুন্নিসা ফাউন্ডেশন এর ব্যবস্হাপনা পরিচালক, মরহুম এম আর…