নেত্রকোনার পূর্বধলা উপজেলার বিশকাকুনী ইউনিয়নের বিষমপুর গ্রামে আজ বুধবার দুপুরে পুকুরের পানিতে ডুবে রিয়াদ (২) ও মাসুম (৩) নামের দুই চাচাত ভাইয়ের মৃত্যু হয়েছে। রিয়াদ…

Posts published in “প্রচ্ছদ”

“অধিকার আদায়ে আমরা, সবাই এক সাথে” এই স্লোগানকে সামনে রেখে নেত্রকোণার পূর্বধলায় বাংলাদেশ ফার্মাসিউটিক্যালস রিপ্রেজেন্টেটিভ এ্যাসোসিয়েশন (ফারিয়া)’র পূর্বধলা উপজেলা শাখার উদ্যোগে কর্মবিরতি ও প্রতিবাদী মানববন্ধন…

নেত্রকোনার পূর্বধলা উপজেলার ধলামূলগাঁও ইউনিয়নের উপ নির্বাচনে শেষ মুহূর্তে প্রার্থীদের ব্যাপক প্রচারণা চলছে। চেয়ারম্যান পদে বাংলাদেশ আওয়ামীলীগ মনোনীত ১জন এবং স্বতন্ত্র ১০জনসহ মোট ১১জন প্রার্থী…

নেত্রকোনার পূর্বধলা উপজেলার গোহালাকান্দা ইউনিয়ন পরিষদের সামনের সড়কে আজ শনিবার সন্ধ্যায় দ্রুতগামী ট্রাকের চাকায় পিষ্ঠ হয়ে জয় (১০) নামের শিশুর মৃত্যু হয়েছে। নিহত জয় গোহালাকান্দা…

নেত্রকোনার পূর্বধলা বাজারের জামতলা এলাকায় আজ বৃহস্পতিবার দুপুরে বিদ্যুতের সর্ট সার্কিটের সৃষ্ট আগুনে ২টি দোকানঘর পুড়ে ভস্মিভূত হয়েছে। এতে নগদ অর্থ ও মালামালসহ প্রায় ১১/১২…

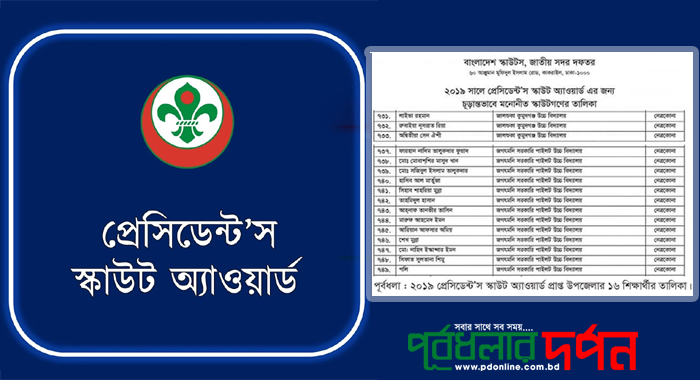

২০১৯ সালের প্রেসিডেন্ট’স স্কাউট অ্যাওয়ার্ডের জন্য নেত্রকোনার পূর্বধলার উপজেলার ১৬ কৃতি শিক্ষার্থী চূড়ান্ত মনোনয়ন লাভ করেছে। উপজেলার জালশুকা কুমুদগঞ্জ উচ্চ বিদ্যালয়ের ৩ ও পূর্বধলা জগৎমণি…

নেত্রকোণা পূর্বধলায় “জাতি, ধর্ম ও দল নির্বিশেষে, রক্ত দিব হেসে হেসে” স্লোগান নিয়ে প্রতিষ্ঠিত রক্তমিতা ফোরাম আজ মঙ্গলবার ১ম প্রতিষ্ঠা বার্ষিকী অনুষ্ঠান পালন করবে। এ…

সারাদেশের বিভিন্ন স্থানে ধর্ষণ ও নারী নির্যাতনের প্রতিবাদে নেত্রকোণার পূর্বধলায় মানববন্ধন ও প্রতিবাদ সভা অনুষ্ঠিত হয়েছে। রোববার (১১ অক্টোবর) উপজেলার থানা রোডে বাংলাদেশ উদীচী শিল্পী…

নেত্রকোণার পূর্বধলার মঙ্গলবাড়িয়ায় ফাঁসিতে ঝুলে দোলন মিয়া (৪১) নামের এক ব্যক্তি আত্মহত্যা করেছে। বৃহস্পতিবার (০৮ অক্টোবর) ঝুলন্ত অবস্থায় তার লাশ উদ্ধার করেছে পূর্বধলা থানা পুলিশ।…

“সুস্থ সমাজের কীট ধর্ষকদের বিরুদ্ধে গর্জে উঠো বাংলাদেশ” ¯স্লোগানকে সামনে রেখে নেত্রকোণার পূর্বধলায় নোয়াখালীতে গৃহবধুকে পাশবিক নির্যাতনকারিদের ও সকল ধর্ষনের ঘটনায় জড়িতদের ফাঁসির দাবীতে বিক্ষোভ…

মুজিববর্ষ উপলক্ষে নেত্রকোণার পূর্বধলায় ‘স্মার্ট লাইভস্টক ভিলেজ’ কার্যক্রমের অংশ হিসেবে উপজেলা প্রাণি সম্পদ দপ্তরের উদ্যোগে ফ্রি ভেটেরিনারি মেডিকেল ক্যাম্প অনুষ্ঠিত হয়েছে। মঙ্গলবার (২৯ সেপ্টেম্বর) উপজেলার…