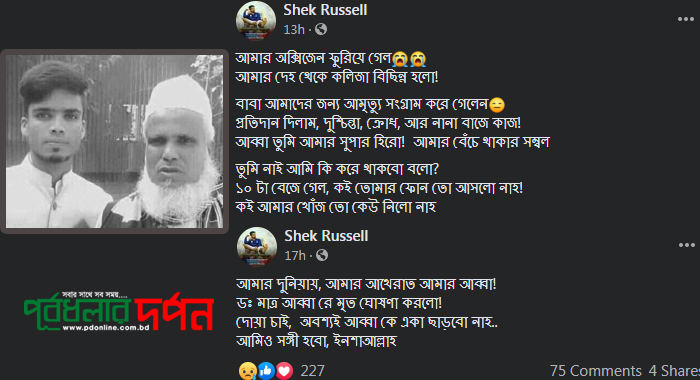

ফেসবুকে স্ট্যাটাস দিয়ে নেত্রকোণার পূর্বধলায় শেখ রাসেল (২৩) নামের এক কলেজ ছাত্র ফাঁসিতে ঝুলে আত্মহত্যা করেছে। বুধবার (১১ নভেম্বর) রাতে এ ঘটনা ঘটেছে। সে উপজেলার…

Posts published in “প্রচ্ছদ”

নেত্রকোণার পূর্বধলায় করোনা প্রতিরোধ কমিটির সভা উপজেলা নিবার্হী অফিসারের কার্যালয়ে অনুষ্ঠিত হয়েছে। বুধবার (১১ নভেম্বর) উপজেলা প্রশাসন এ সভার আয়োজন করে।উপজেলা নির্বাহী অফিসার উম্মে কুলসুম’র…

নেত্রকোণার পূর্বধলা উপজেলা যুবলীগের উদ্যোগে পৃথক পৃথক স্থানে বাংলাদেশ আওয়ামী যুবলীগের ৪৮তম প্রতিষ্ঠাবার্ষিকী উপলক্ষে র্যালি, কেক কাটা, আলোচনা সভা ও দোয়া মাহফিল অনুষ্ঠিত হয়েছে। বুধবার…

নেত্রকোণার পূর্বধলায় আজ মঙ্গলবার সাবেক উপজেলা চেয়ারম্যান ও উপজেলা বিএনপির প্রতিষ্ঠাতা সভাপতি মুস্তাক আহামেদ এর ৮ম মৃত্যুবার্ষিকী উপলক্ষে কালো পতাকা উত্তোলন, কবর জিয়ারত, স্মরণ সভা…

নেত্রকোনা পূর্বধলায় ঐতিহাসিক ৭ নভেম্বর জাতীয় বিপ্লব ও সংহতি দিবস পালন করেছে পূর্বধলা উপজেলা বিএনপি, অঙ্গ ও সহযোগী সংগঠনের নেতৃবৃন্দ। গতকাল শনিবার বিকেলে পূর্বধলা রেলওয়ে…

নেত্রকোনা পূর্বধলায় বিদ্যুৎস্পৃষ্ট হয়ে জারিয়া ইউনিয়নের সাবেক চেয়ারম্যান মতিউর রহমান (৭৭) মৃত্যু হয়েছে। আজ মঙ্গলবার দুপুরে পূর্বধলা সদরের নিজ বাসার পুকুরে এ দুর্ঘটনা ঘটে।পরিবার ও…

নেত্রকোনার পূর্বধলা উপজেলার খলিশাপুর ইউনিয়নে গতকাল ২৮ অক্টোবর শেখ হাসিনার নির্দেশে “গাছ লাগান পরিবেশ বাঁচান” কর্মসূচির আওতায় ফলদ বৃক্ষ রোপন করা হয়েছে। বীর মুক্তিযোদ্ধা আবদুল…

নেত্রকোনার পূর্বধলা উপজেলা শাখা বাংলাদেশ আওয়ামী স্বেচ্ছাসেবক লীগের বর্ধিত সভা স্থগিত করা হয়েছে। পূর্বধলা উপজেলা স্বেচ্ছাসেবক লীগের আহবায়ক আ. মোতালেব এ তথ্য নিশ্চিত করেন।২৮ অক্টোবর…

২৮ অক্টোবর ২০২০ বুধবার পূর্বধলা উপজেলা আওয়ামী স্বেচ্ছাসেবক লীগের বর্ধিত সভাকে ঘিরে ঘটতে পারে সংঘর্ষের ঘটনা এমনটাই জানিয়েছেন উপজেলা আওয়ামী স্বেচ্ছাসেবক লীগের যুগ্ম আহবায়ক আনোয়ার…

নেত্রকোণা জেলার পূর্বধলা উপজেলায় আজ শুক্রবার জাতীয় গণমাধ্যম ইনস্টিটিউটের উদ্যোগে ইলেকট্রনিক ও প্রিন্ট মিডিয়ার ২৫ জন গণমাধ্যমকর্মীদের নিয়ে P4D (Platforms for Dialogue) প্রকল্পের আওতায় ২…

নেত্রকোনার পূর্বধলা উপজেলায় বেসরকারি শিক্ষা প্রতিষ্ঠান তৃতীয় শ্রেণির কর্মচারী পরিষদ গঠিত হয়েছে। ৩১ সদস্যের কার্যকরি পরিষদের সভাপতি পদে মো. আশরাফ উজ্জামান আকন্দ ও সাধারন সম্পাদক…