নেত্রকোনার পূর্বধলা উপজেলার আগিয়া ইউনিয়নের পশ্চিম বুধী গ্রামের বুধী-স্যাতাটি রাস্তায় কাবিখা প্রকল্পের মাটি কাটাকে কেন্দ্র করে দুই পক্ষের সংঘর্ষে রেজাউল ইসলাম ওরফে টিটু (১৭) নামে […]

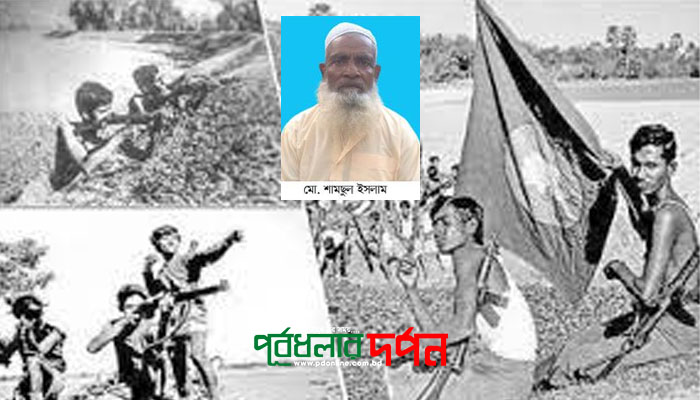

স্বাধীনতা আনলেও শামছুল ইসলাম পাননি মুক্তিযোদ্ধার স্বীকৃতি!

মুক্তিযুদ্ধ করে দেশের স্বাধীনতা ফিরিয়ে আনলেও মুক্তিযোদ্ধা হিসেবে এখনো স্বীকৃতি পাননি নেত্রকোণার পূর্বধলা উপজেলার হোগলা ইউনিয়নের মহেষপট্টি গ্রামের মৃত. ইসমাহিল হোসেনের ছেলে মো. শামছুল ইসলাম। […]

পূর্বধলায় ৭ কেজি গাঁজাসহ ১ মাদক কারবারি আটক

নেত্রকোণার পূর্বধলায় ৭ কেজি গাঁজাসহ মোঃ আনারুল ইসলাম (১৯) নামে এক মাদক কারবারিকে আটক করেছে পুলিশ। রোববার ( ১০ ডিসেম্বর) পূর্বধলা থানার ভারপ্রাপ্ত কর্মকর্তা (ওসি) […]

পূর্বধলায় প্রাথমিক শিক্ষক সমিতির কমিটি গঠন

নেত্রকোনার পূর্বধলায় বাংলাদেশ প্রাথমিক শিক্ষক সমিতির পূর্বধলা উপজেলা শাখা’র ত্রি-বার্ষিক সম্মেলন অনুষ্ঠিত হয়েছে। এতে সর্বসম্মতিক্রমে আগিয়া সরকারি প্রাথমিক বিদ্যালয়ের প্রধান শিক্ষক মোঃ রুহুল আমিনকে সভাপতি, […]

পূর্বধলায় আন্তর্জাতিক দুর্নীতি বিরোধী দিবস-২০২৩ পালিত

উন্নয়ন, শান্তি ও নিরাপত্তার লক্ষ্যে দুর্নীতির রিরুদ্ধে আমরা ঐক্যবদ্ধ এই প্রতিপাদ্যকে সামনে রেখে নেত্রকোণার পূর্বধলায় আন্তর্জাতিক দুর্নীতি বিরোধী দিবস পালন উপলক্ষে উপজেলা প্রশাসনের আয়োজনে শনিবার […]

যথাযোগ্য মর্যাদায় পূর্বধলায় হানাদার মুক্ত দিবস পালিত

নেত্রকোণার পূর্বধলায় যথাযথ মর্যাদায় ব্যাপক কর্মসূচীর মধ্য দিয়ে পূর্বধলা হানাদার মুক্ত দিবস পালিত হয়েছে। কর্মসূচীর মধ্যে ছিল পুস্পস্তবক অর্পণ, বর্ণাঢ্য বিজয় র্যালী ও আলোচনা সভা। […]

পূর্বধলায় প্রতিবন্ধী শিশু ধর্ষণের অভিযোগে ঘটক তাহের আটক

নেত্রকোণার পূর্বধলায় ”পূর্বধলা কাচারী আশ্রায়ন” প্রকল্পে’র ৮ বছরের বোবা শিশু ধর্ষণে’র অভিযোগে ঘটক আবু তাহেরকে আটক করেছে পূর্বধলা থানার পুলিশ। বৃহস্পতিবার (৭ ডিসেম্বর) দুপুর দেড়টায় […]

পূর্বধলায় বিনামূল্যে সার ও বীজ পেলেন ৯ হাজার ২শ জন প্রান্তিক কৃষক

নেত্রকোণার পূর্বধলায় ক্ষুদ্র ও প্রান্তিক কৃষকের মাঝে বিনামূল্যে ধান বীজ ও রাসায়নিক সার বিতরণ করা হয়েছে। উপজেলা কৃষি সম্প্রসারণ অধিদপ্তরে’র উদ্যোগে উৎপাদন বৃদ্ধির লক্ষ্যে প্রণোদনা […]

পূর্বধলায় পৌনে ২ কোটি টাকার রাস্তা ৫ মাসেই বেহাল দশা!

নেত্রকোণার পূর্বধলায় স্টেশন বাজার থেকে পূর্বধলা বাজার পর্যন্ত জিওবি মেইনটেন্স প্রকল্পের আওতায় প্রায় ১২শ ৮৫ মিটার রাস্তার ৭ শ মিটার আরসিসি বাকি ৫শ ৮৫ মিটার […]

নেত্রকোণা-৫ (পূ্র্বধলা) আসনে ৩ স্বতন্ত্র প্রার্থীর মনোনয়ন বাতিল

দ্বাদশ জাতীয় সংসদ নির্বাচনে প্রতিদ্বন্দ্বিতার জন্য স্বতন্ত্র প্রার্থী হিসেবে মনোনয়নপত্র জমা দেওয়া জাহাঙ্গীরনগর বিশ্ববিদ্যালয়ের সাবেক উপাচার্য অধ্যাপক ড. আনোয়ার হোসেন, সাবেক ছাত্রনেতা ইঞ্জিনিয়ার মিছবাহুজ্জামান চন্দন […]

পূর্বধলা উপজেলা স্বাস্থ্য কমপ্লেক্সে প্রতিষ্ঠার ৪৮ বছর পর অপারেশন থিয়েটার (ওটি) চালু

নেত্রকোণার পূর্বধলায় হাসপাতাল প্রতিষ্ঠার দীর্ঘ ৪৮বছর পর পূর্বধলা উপজেলা স্বাস্থ্য কমপ্লেক্সে চালু হলো অপারেশন থিয়েটার (ওটি)। আজ (০৩ ডিসেম্বর)দুপুরে পূর্বধলা উপজেলা স্বাস্থ্য কমপ্লেক্সে সিজারিয়ান অপারেশন […]