নেত্রকোনার পূর্বধলা উপজেলার ধলামূলগাঁও ইউনিয়নের জামুদ গ্রামে গতকাল শনিবার দিবাগত রাতে পারিবারিক কলহের জেরে টপি আক্তার (২৮) নামে এক গৃহবধূকে হত্যার অভিযোগ উঠেছে স্বামী কুদরত…

Posts published in “প্রচ্ছদ”

নেত্রকোণার পূর্বধলায় আজ শনিবার (২৬ ফেব্রুয়ারি) দুপুরে পুলিশকে আহত করে বুলবুল (২৮) নামে এক ওয়ারেন্টভুক্ত পলাতক আসামিকে চিনিয়ে নেয় স্বজনরা। সে উপজেলার পূর্ব ভিকুনিয়া গ্রামের…

নেত্রকোণার পূর্বধলা উপজেলা নির্বাহী অফিসারের হস্তক্ষেপে বাল্যবিয়ের হাত থেকে রক্ষা পেয়েছে দশম শ্রেণীর এক ছাত্রী (১৬)। ওই ছাত্রীর বিয়ের খবর পেয়ে আজ শুক্রবার দুপুরে উপজেলা…

২১শে ফেব্রুয়ারি শহীদ দিবস ও আন্তর্জাতিক মাতৃভাষা দিবস পালন উপলক্ষে নেত্রকোণার পূর্বধলায় আজ সোমবার কবিতা আবৃত্তি ও চিত্রাংকন প্রতিযোগিতা অনুষ্ঠিত হয়েছে। বঙ্গবন্ধু ফাউন্ডেশন ও পূর্বধলা…

একুশে ফেব্রুয়ারি মহান শহিদ দিবস ও আন্তর্জাতিক মাতৃভাষা দিবসের প্রথম প্রহরে নেত্রকোণার পূর্বধলা কেন্দ্রীয় শহিদ মিনারে পুষ্পস্তবক অর্পণ করে ভাষা শহিদদের প্রতি গভীর শ্রদ্ধা নিবেদন…

মহান শহিদ দিবস ও আন্তর্জাতিক মাতৃভাষা দিবস উপলক্ষে সকল ভাষা শহিদদের প্রতি গভীর শ্রদ্বা জানান #মাজহারুল_ইসলাম_সোহেল, সহ-সভাপতি, ঢাকা মহানগর উত্তর কৃষক লীগ।

নেত্রকোণার পূর্বধলায় সামাজিক সংগঠন বীর মুক্তিযোদ্ধা আবদুল হাননান খান ফাউন্ডেশন ও পূর্বধলা পরিবেশ আন্দোলন’র উদ্যোগে ৩ জীবিত ও ৫ মরনোত্তর সহ মোট ৮ ভাষা সৈনিক…

এডহক কমিটির সভাপতি বেতন বিলে স্বাক্ষর না করায় নেত্রকোনার পূর্বধলা উপজেলার তেনুয়া উচ্চ বিদ্যালয়ের শিক্ষক কর্মচারীরা চলতি বছরের জানুয়ারী মাসের বেতন পাচ্ছেন না বলে অভিযোগ…

পূবর্ধলা উপজলোয় গত সোমবার (৩১ জানুয়ারী) প্রথমবারের মতো ধলামূলগাঁও ইউনিয়ন পরিষদ নির্বাচন ব্যালট পেপার ছাড়া অনুষ্ঠিত হয়েছে। নির্বাচনে ব্যালট পেপারের জায়গায় ইলেক্ট্রনিক ভোটিং মেশিন (ইভিএম)…

আজ ০৭ ফেব্রুয়ারী পূর্বধলা- ধোবাউড়া নির্বাচনী এলাকার সাবেক দুইবারের সংসদ সদস্য বীর মুক্তিযোদ্ধা এডভোকেট মোশাররফ হোসেন’র ১২ তম মৃত্যুবার্ষিকী। গত ২০১০ সালের এই দিনে তিনি…

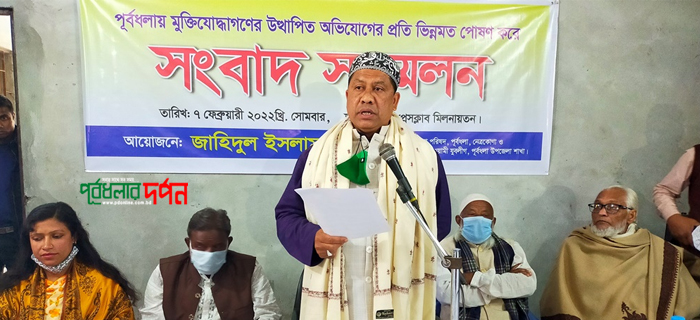

পূর্বধলায় মুক্তিযোদ্ধাগণের উত্থাপিত অভিযোগ প্রত্যাখ্যান করে আজ ৭ ফেব্রুয়ারি সোমবার পূর্বধলা প্রেসক্লাব মিলনায়তনে সংবাদ সম্মেলন করেন উপজেলা চেয়ারম্যান ও উপজেলা যুবলীগের সভাপতি জাহিদুল ইসলাম সুজন।…