The brand new savings has been suffering from the consequences away from COVID and income is at chance. You may also question if it is foolhardy to invest in a new possessions while already secured for cash.

Naturally, a lot of people want to get back again to the market industry. But if your money falls once more otherwise pricing beginning to fall, this could be high-risk obtainable and you may a lot of time-name economic balance.

If you prefer more income for the short term it could be much better to not ever exposure extra personal debt towards the several other home pick up to anything stabilize financially.

What exactly are My personal Top Possibilities?

You need to examine what you are trying to go. And you will envision in your condition whether it is best to borrow extra money, otherwise buy and sell.

When you yourself have collateral in your home and they are offered to purchase various other home, it could be sensible to offer and buy the fresh domestic. This may enables you to make a much bigger pick without a few mortgage loans at a time. Most people pick selling their house becoming a much much easier procedure than just checking out the loan application and you can recognition techniques.

One thing to thought is that you should keep your house for the next play with, such renting it or using it as security towards the future funds.

It is important not just to examine if or not looking after your domestic helps you to save money in that one eg and just how that choice make a difference anything down the line.

It indicates which have an idea just before borrowing from the bank of collateral. Make sure that you may be conscious of most of the benefits and drawbacks so it is possible to make the best decision about what is perfect for you!

Do you want in order to Retire or Downsize Your house?

This may have the benefit of getting rid of all mortgage loans, which have yet another domestic, and money regarding lender. It is convenient and you will worry-free versus getting extra financial obligation and you may counting on tenants so you’re able to take care of your house and you can expenses lease timely.

Do you need to Include a rental Assets into Profile?

If you are considering including accommodations property into the collection, it tends to make even more sense and become beneficial for your requirements to use the newest collateral in your home. In addition has many professionals inside the taking up the fresh debt from another lender.

The advantage of this is you to unlike make payment on lease with money coming out of pouch per month, anyone else will pay the mortgage – very discover a full time income stream currently put up with no performs needed from you!

However, think of, to find a residential property is actually a corporate and also in any company, there’s some risk you must be confident with.

You noticed the options and also you still can not determine what in order to do? That is okay! The key simply to make the decision.

What is going to You choose?

If you were to think given that home values is going to continue going up, next getting other home could be best however, if out of upcoming speed develops. Must i play with a home equity financing to buy other home?

If you intend into getting your local area, it might not getting worth it to possess a guarantee financing since costs you can expect to transform otherwise possessions philosophy disappear throughout the years.

For many of us attempting to sell their property, to order an alternate house is the best option. But rather than waiting to pick people, you have access to our website to rating a profit provide to your your residence today.

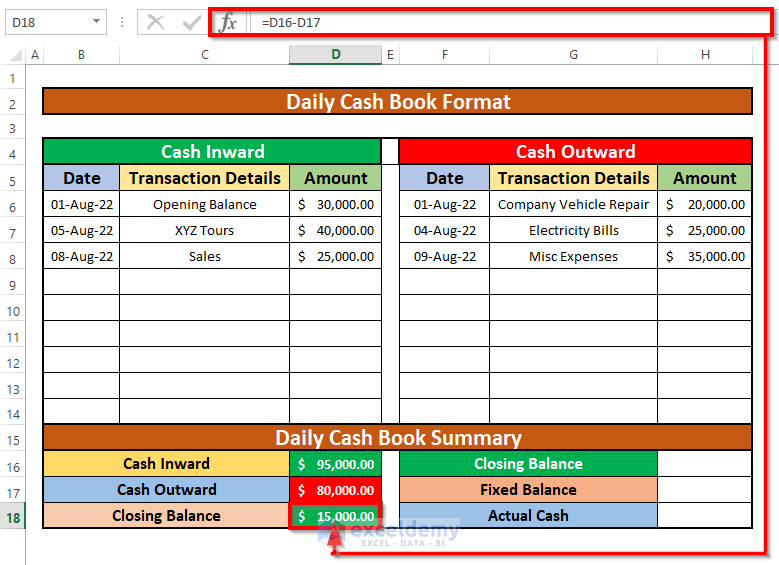

Simply take into consideration the cost of each other mortgage loans and you may in case the earnings is support the a lot more mortgage payments. It is crucial that these types of data will work for you as better since your members of the family. Which have a realistic idea of just how much your repayments would be is important to work out cost. It is important to not overextend on your own financially.

Be First to Comment