নেত্রকোনার পূর্বধলায় নাজমূল (২৮) নামের এক যুবকের রহস্যজনক মৃত্যু হয়েছে। মঙ্গলবার (৩০ মে) ভোর রাতে নাজমুলকে অসুস্থ অবস্থায় তার দুই বন্ধু নেত্রকোনা আধুনিক সদর হাসপাতালের […]

পূর্বধলায় ঘূর্ণিঝড়ে ক্ষতিগ্রস্তদের মাঝে ঢেউটিন ও গৃহ নির্মাণের চেক বিতরণ

নেত্রকোনার পূর্বধলায় সাম্প্রতিক ঘূর্ণিঝড় ও শিলা বৃষ্টিতে ক্ষতিগ্রস্ত অসহায় দুস্থ ও দরিদ্র পরিবারের মাঝে ঢেউটিন ও গৃহ নির্মাণের চেক বিতরণ করা হয়েছে। আজ সোমবার (২৯ […]

পূর্বধলায় চায়ের দোকানে টেলিভিশন ক্রিকেট জুয়া বন্ধে ওসির প্রচারণা

পূর্বধলায় চায়ের দোকানে টাকা ধরে ক্যারাম খেলা ও টেলিভিশনে ক্রিকেট জুয়া বন্ধে দোকান থেকে ক্যারাম ও টিভি অপসারণ শুরু করেছে নেত্রকোনার পূর্বধলা থানা পুলিশ। আজ […]

পূর্বধলায় আহমদ হোসেনের নির্দেশে শেখ হাসিনাকে হত্যার হুমকির প্রতিবাদে বিক্ষোভ মিছিল

নেত্রকোণা পূর্বধলা উপজেলায় বাংলাদেশ আওয়ামী লীগের সাংগঠনিক সম্পাদক আহমদ হোসেনের নির্দেশে পূর্বধলা উপজেলা আওয়ামী লীগের নেতৃবৃন্দ প্রধানমন্ত্রী শেখ হাসিনাকে প্রকাশ্য জনসভায় বিএনপি নেতৃবৃন্দ কর্তৃক হত্যার […]

পূর্বধলায় প্রধান শিক্ষকের বিরুদ্ধে শিক্ষক নিয়োগে অনিয়ম ও অর্থ আত্মসাৎ এর অভিযোগ

নেত্রকোনার পূর্বধলায় রাগীব মুজিব উচ্চ বিদ্যালয়ের প্রধান শিক্ষক মোঃ আতাহার আলী’র বিরুদ্ধে নিয়োগে অর্থ আত্মসাৎসহ নানা অভিযোগ উঠেছে। ১৯৯৫ ইং সনে উপজেলার পূর্বধলা সদর ইউনিয়নের […]

পূর্বধলায় শেখ হাসিনার স্বদেশ প্রত্যাবর্তন দিবস পালিত

সারাদেশের ন্যায় নেত্রকোনার পূর্বধলায় প্রধানমন্ত্রী শেখ হাসিনার ৪৩তম স্বদেশ প্রত্যাবর্তন দিবস পালিত হয়েছে। দিবসটি উপলক্ষে আ.লীগের সাংগঠনিক সম্পাদক আহমদ হোসেন’র নির্দেশনায় বুধবার (১৭ মে) উপজেলা […]

সেই তায়্যিবার চিকিৎসার দায়িত্ব নিল উপজেলা প্রশাসন

নেত্রকোণার পূর্বধলা উপজেলা ঘাগড়া ইউনিয়নের লেটিরকান্দা বিরল রোগে আক্রান্ত তায়্যিবা(৮)। এ সংক্রান্ত একটি সংবাদ স্থানীয় ও জাতীয়ভাবে প্রচারের পর সেই তায়্যিবার চিকিৎসার দায়িত্ব নিল পূর্বধলা […]

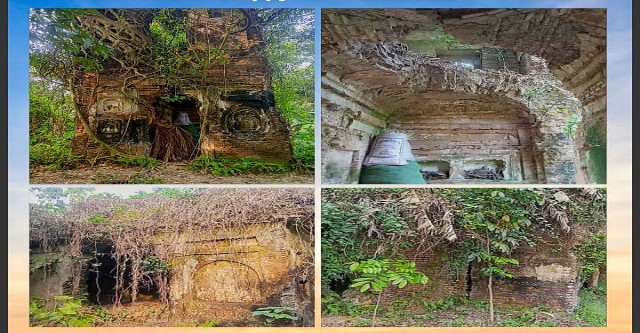

সংরক্ষণের অভাবে হারিয়ে যাচ্ছে নারায়নডহর জমিদার বাড়ি!

নেত্রকোণা জেলার পূর্বধলা উপজেলার নারায়ণডহর গ্রামে অবস্থিত এক ঐতিহাসিক জমিদার বাড়ি। বর্তমানে নারায়ণডহর পূর্বধলা উপজেলার একটি অন্যতম জমজমাট বাজার হিসেবে ব্যবহৃত হলেও প্রাচীন জমিদার বাড়ীর […]

আহমদ হোসেন এর মানবিক সহায়তায় অসহায় রোগীর চিকিৎসা ব্যবস্হা!

মোছাঃ সালমা আক্তার। বয়স ২৮ বছর। এক কন্যা সন্তানের জননী। দরিদ্রতার কষাঘাতে দূর্বিষহ যার জীবন। তার উপর দুটো কিডনীই ড্যামেজ। মরার উপর খাড়ার ঘা যাকে […]

পূর্বধলায় কৃষকলীগের ধান কর্তন উৎসব

নেত্রকোণার পূর্বধলায় উপজেলার সদর ইউনিয়নের শালদিঘা গ্রামের কৃষক আকবর আলীর ৮০ শতাংশ ক্ষেতের ধান কেটে দিয়েছে নেত্রকোণা জেলা কৃষক লীগ। আজ বৃহঃপতিবার (১১ ই মে) […]

পূর্বধলায় ধান কেটে দিল ছাত্রলীগ নেতা

দিগন্ত বিস্তৃত ফসলের মাঠ ছেয়ে গেছে সোনালি ধানে। দুর্যোগে সে ধান নষ্ট হওয়ার আগেই ঘরে তুলতে হবে। শ্রমিক সংকটে অল্পসময়ে ধানকাটা নিয়ে দুশ্চিন্তায় ছিলেন কৃষকরা। […]