স্কুল-কলেজের ছাত্রছাত্রীরা ডিভাইসে আসক্ত না হয়ে বই পড়ার অভ্যাস গড়ে তুলতে তাদের মন ও বয়সের উপযোগী সুন্দর, সুখপাঠ্য এবং উন্নত মানসম্পন্ন বইপড়ার মাধ্যমে পরিপূর্ণ ও […]

দুর্গাপুজা উপলক্ষে পূর্বধলা থানায় নিরাপত্তা বিষয়ক মতবিনিময় সভা অনুষ্ঠিত

নেত্রকোনার পূর্বধলায় আসন্ন শারদীয় দুর্গাপূজা উদযাপন উপলক্ষে নিরাপত্তা বিষয়ক মতবিনিময় সভা অনুষ্ঠিত হয়েছে। সনাতন ধর্মাবলম্বীদের বড় উৎসব শারদীয় দুর্গাপূজা উপলক্ষে পূর্বধলা থানা পুলিশের আয়োজনে শুক্রবার […]

পূর্বধলার উন্নয়নে নৌকার পক্ষে কাজ করতে চান ড. নাদিয়া বিনতে আমিন

ড. নাদিয়া বিনতে আমিন বাংলাদেশে নারীর কর্মসংস্থান ও অর্থনৈতিক সক্ষমতা অর্জনের জন্য নারী উদ্যোক্তাদের জন্য দীর্ঘ সময় ধরে কাজ করছেন। তিনি একজন বিশিষ্ট নারী উদ্যোক্তা […]

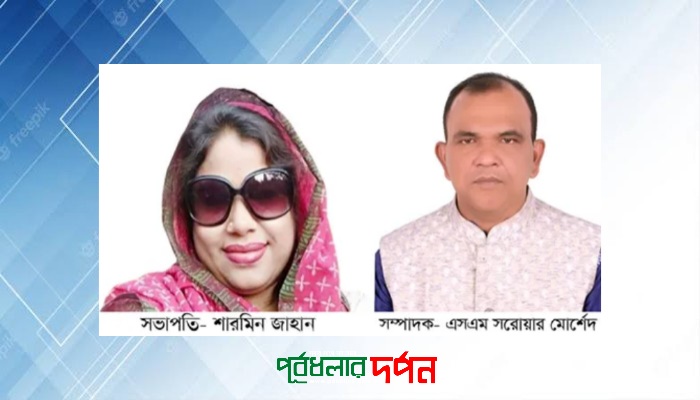

ঢাবি বৃহত্তর ময়মনসিংহ কল্যাণ সমিতির সভাপতি পূর্বধলার শারমিন, সম্পাদক সরোয়ার

ঢাকা বিশ্ববিদ্যালয়ে বৃহত্তর ময়মনসিংহ কল্যাণ সমিতির নতুন সভাপতি সহকারী রেজিস্ট্রার শারমিন জাহান ও সাধারণ সম্পাদক এসএম সরোয়ার মোর্শেদ। ২৬ সেপ্টেম্বর, মঙ্গলবার বিকেলে আধুনিক ভাষা ইনস্টিটিউট […]

পূর্বধলায় অজ্ঞাত যুবকের লাশ উদ্ধার

নেত্রকোনার পূর্বধলায় অজ্ঞাত এক ব্যক্তির (৩৫) লাশ উদ্ধার করেছে পূর্বধলা থানার পুলিশ। আজ মঙ্গলবার (২৬ সেপ্টেম্বর) সকালে উপজেলার গোহালাকান্দা ইউনিয়নের ইসবপুর গ্রাম থেকে এ লাশ […]

পূর্বধলায় প্রাথমিক বিদ্যালয়গুলোতে শহিদ মিনার নির্মাণ

নেত্রকোণার পূর্বধলায় প্রাথমিক ও গণশিক্ষা মন্ত্রণালয়ের নির্দেশনায় প্রাথমিক বিদ্যালয় গুলোতে শহিদ মিনার স্থাপনের উদ্যোগ নেয় উপজেলা প্রশাসন। সেই নির্দেশনার পরিপ্রেক্ষিতে শহিদ মিনার স্থাপনের উপজেলা নির্বাহী […]

পূর্বধলায় পারিবারিক কবর থেকে ৪ টি লাশ চুরি

পূর্বধলা উপজেলার গোহালাকান্দা ফকির বাড়ির পারিবারিক কবর স্থান থেকে এক জন পূরুষ ও তিনজন মহিলার লাশ চুরি করে নিয়ে গেছে একদল চোর। বৃহস্পতিবার ২১ সেপ্টেম্বর […]

পূর্বধলায় বালুবোঝাই ট্রাক নিয়ন্ত্রণ হারিয়ে চালক নিহত

নেত্রকোনা জেলার পূর্বধলা উপজেলার শ্যামগঞ্জ-বিরিশিরি সড়কের গুজাখালীকান্দা এলাকায় এ দূর্ঘটনা ঘটে। একটি যাত্রীবাহী বাসকে সাইড দিতে গিয়ে নিয়ন্ত্রণ হারিয়ে সড়কের পাশে খাদে পড়ে যায় ট্রাকটি। […]

বিশ্ব-নরসুন্দর দিবস উদযাপন উপলক্ষে পূর্বধলায় র্যালি ও আলোচনা সভা

‘সমবায়-ই শক্তি, সমবায়-ই মুক্তি’ এই স্লোগানকে সামনে নিয়ে নেত্রকোনার পূর্বধলায় বিশ্ব-নরসুন্দর দিবস উদযাপিত হয়েছে। আজ শনিবার সকাল সাড়ে এগারোটায় পূর্বধলা কেন্দ্রীয় শহীদ মিনার সংলগ্ন মোস্তফা […]

আবদাল খাঁ’র জীবনের শেষ আকুতি একটি ঘর

নেত্রকোণার পূর্বধলায় দারিদ্র সীমার নিচে জীবনযাপন করেছেন আবদাল খাঁ ও বিউটি আক্তার দম্পত্তি। তাদের নিবাস উপজেলার জারিয়া ইউনিয়নের বাড়হা উত্তরা পাড়া গ্রামে। পৈত্রিক সূত্রে পাওয়া […]

পূর্বধলায় গ্লোবাল ক্লাইমেট স্ট্রাইক ডে উপলক্ষ্যে বৈশ্বিক জলবায়ু ধর্মঘট পালিত

ক্ষতিকর জীবাশ্ম জ্বালানির ব্যবহার বন্ধ ও নবায়নযোগ্য জ্বালানি প্রসারের দাবিতে বৈশ্বিক জলবায়ু ধর্মঘট পালন করেছেন তরুণ জলবায়ু কর্মীরা। শুক্রবার (১৫ সেপ্টেম্বর) নেত্রকোণা পূর্বধলা উপজেলা পরিষদ […]