নেত্রকোনার পূর্বধলায় মহান শহীদ দিবস ও আন্তর্জাতিক মাতৃভাষা দিবস উপলক্ষে ভাষা শহীদ ও ভাষা সৈনিকদের স্মরণে “আর্ট ক্যাম্প উন্মুক্ত প্রদর্শনী” অনুষ্ঠিত হয়েছে। সেন্টার ফর এডুকেশন […]

ভাষা শহীদদের প্রতি পূর্বধলা উপজেলা আওয়ামীলীগে’র শ্রদ্ধাঞ্জলি

মহান শহীদ দিবস ও আন্তর্জাতিক মাতৃভাষা দিবস উপলক্ষে শহীদ মিনারে পুষ্পস্তবক অর্পণ করে ভাষা শহীদদের প্রতি গভীর শ্রদ্ধা নিবেদন করেছে পূর্বধলা উপজেলা আওয়ামী লীগ। বুধবার […]

“শহীদ দিবসের বিশ্বায়ন” – অধ্যাপক মোঃ এমদাদুল হক বাবুল

একুশে ফেব্রুয়ারি বাঙালি জাতির জাতীয় জীবনে চির প্রেরণা ও অবিস্মরণীয় একটি দিন। এটি শুধু বাংলাদেশের নয়,এটি এখন গোটা বিশ্বের আন্তর্জাতিক মাতৃভাষা দিবস হিসেবে পালিত হচ্ছে।”একুশ” […]

জেলা প্রশাসক আন্তঃ উপজেলা টি-২০ ক্রিকেট টুর্নামেন্টে পূর্বধলা রানার্স আপ

নেত্রকোণা জেলা ক্রীড়া সংস্থার ব্যবস্থাপনায় জেলা প্রশাসক আন্তঃ উপজেলা টি-২০ ক্রিকেট টুর্নামেন্ট চ্যাম্পিয়ন হয়েছে নেত্রকোণা সদর টিম। জেলা শহরের সাতপাই ইনডোর স্টেডিয়াম মাঠে আজ মঙ্গলবার […]

পূর্বধলায় মিথ্যা মামলা প্রত্যাহারের দাবিতে মানববন্ধন

নেত্রকোনার পূর্বধলার বিশকাকুনি ইউনিয়নে’র নৈগাঁও গ্রামে রোববার (১৮ ফেব্রুয়ারি) দুপুরে গৃহবধুকে শ্লীলতাহানি, বসতবাড়ি দখল, মারধরের ঘটনায় শাস্তির দাবিতে এবং উপজেলা সার্ভেয়ার কতৃক ২৩ জনের বিরুদ্ধে […]

পূর্বধলায় জাতীয় প্রাথমিক শিক্ষা পদক প্রতিযোগিতা অনুষ্ঠিত

নেত্রকোণার পূর্বধলায় উপজেলা পর্যায়ে জাতীয় প্রাথমিক শিক্ষা পদক প্রতিযোগিতা অনুষ্ঠিত হয়েছে। শনিবার (১৭ ফেব্রুয়ারি) সকালে উপজেলার শেখ রাসেল মিনি স্টেডিয়ামে এই প্রতিযোগিতার আয়োজন করা হয়। […]

পূর্বধলায় ৭ টি কেন্দ্রে এসএসসি ও সমমানের পরীক্ষা অনুষ্ঠিত

নেত্রকোণার পূর্বধলা উপজেলায় শান্তিপূর্ণভাবে এসএসসি ও সমমানের পরীক্ষা অনুষ্ঠিত হয়েছে। বৃহস্পতিবার (১৫ ফেব্রুয়ারি ) সকাল ১০টায় একযোগে উপজেলার ৭ টি কেন্দ্রে পরীক্ষা অনুষ্ঠিত হয়। সবগুলো […]

পূর্বধলায় গৃহবধূকে শ্লীলতাহানির অভিযোগে সার্ভেয়ারসহ ৫জনের বিরুদ্ধে মামলা

নেত্রকোনার পূর্বধলায় ভুমি অফিসের সার্ভেয়ার, ইউপি সদস্য ও সরকারি প্রাথমিক বিদ্যালয়ের দুই শিক্ষকসহ ৫ জনের নামে শ্লীলতাহানির অভিযোগে আদালতে মামলা দায়ের করেছেন এক গৃহবধূ। গতকাল […]

পূর্বধলায় নানা আয়োজনে বসন্তবরণ ও পিঠা উৎসব

নেত্রকোনার পূর্বধলা উপজেলা পরিষদ চত্বরে নানা আয়োজনে দিনব্যাপী বসন্তবরণ ও পিঠা উৎসব অনুষ্ঠিত হয়েছে। গত বুধবার (১৪ ফেব্রুয়ারি) পূর্বধলা উপজেলা প্রশাসন ও অফিসার্স ক্লাবের উদ্যোগে […]

কালের বিবর্তনে রবি বর্মণের ৫২ বছরের বাশিঁর আওয়াজ হারিয়ে যাচ্ছে

বাঁশি বাজিয়ে মানুষের মনে জায়গা করে নেওয়াটা একপ্রকার অসাধ্য কাজ। ক্লান্ত ভর-দুপুর কিংবা নিশি রাতে হঠাৎ বাতাসে ভেসে আসে মায়াবী বাঁশির সুর। কি এক সুরে […]

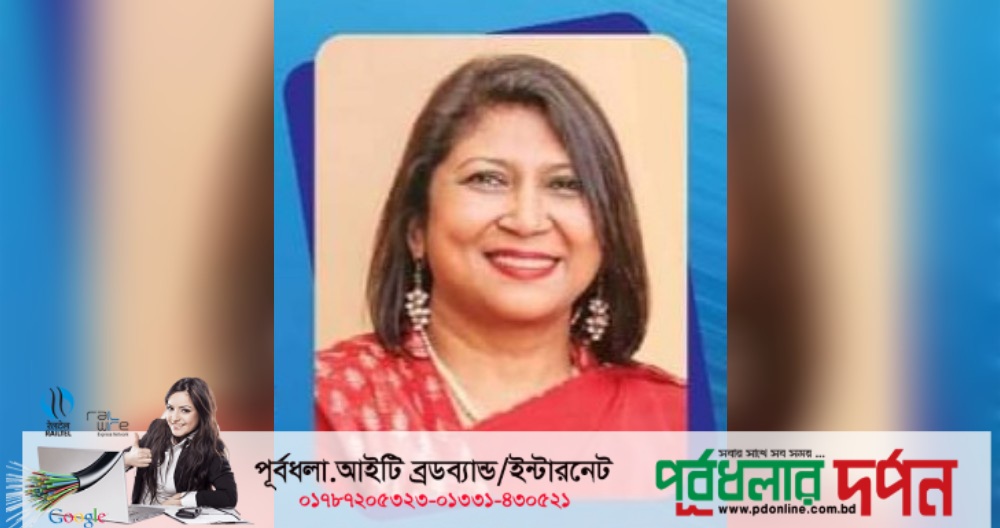

সংরক্ষিত আসনে এমপি হলেন নাদিয়া বিনতে আমিন

আজ অনুষ্ঠিত আওয়ামী লীগের মনোনয়ন বোর্ডে সংরক্ষিত আসনে ৪৮ জন নারী প্রার্থীকে চূড়ান্ত করা হয়েছে। বিকেলে তাদের নাম ঘোষণা করা হয়। এতে নেত্রকোণার নাদিয়া বিনতে […]